“Excellence is never an accident. It is always the result of high intention, sincere effort, and intelligent execution; it represents the wise choice of many alternatives – choice, not chance, determines your destiny.” - Aristotle

Situation in the Market

ILS is no longer novel.[1] While still accounting for only a relatively small portion of the overall reinsurance market and an even smaller portion of the overall capital market, the ILS market has steadily grown and established itself since its inception in the 1990s. The fact that it was previously called alternative capital and increasingly picks up the moniker convergence or partner capital is an indicator of the evolution and maturation of ILS as an integral, embedded part of the risk transfer industry.

The growth prospects of ILS are favorable, as investors increasingly see it as a mainstay asset class in their portfolios owing to its appealing risk/return profile, correlation characteristics, and ESG potential. However, ILS platforms keen to take part in shaping the continued growth of the industry can expect to face an uphill battle to retain and grow market share. ILS platforms are under increasing pressure as they experience growing competition from incumbents and the threat of new market entrants.

Additionally, investors, cedents, and regulators all demand higher levels of sophistication from ILS platforms. Investors increasingly scrutinise the management fees they pay, a tendency amplified in times of extended underperformance such as the period between 2017 and 2019. Investors also increasingly demand quality risk selection, as well as superior access to risk, and they flock toward ILS platforms with proven track records. For their part, cedents demand quicker turnaround times for contracts and competitive prices. Both cedents and investors demand new product offerings with different underlying perils and durations, or with more efficient structures. Investors, regulators, and rating agencies, where applicable, all expect more transparent, timely information about the operations and financials of ILS platforms, including risk sourcing, modeling, and impacting events.

To meet these demands, ILS platforms need increasingly robust and efficient operations. These factors mean that ILS platforms and their operations are coming under close scrutiny and need to differentiate themselves. Some are expanding into new lines of business, perils, or regions. Others are setting up their own fully-fledged, and sometimes rated, reinsurance vehicles, and yet others are trying to find a niche position. As diverse as the responses to the challenges and opportunities are, one thing applies to all of them: a focus on operational excellence can facilitate the execution of strategy and is an expected response to the demands of the market.

What is Operational Excellence and Why Does It Matter?

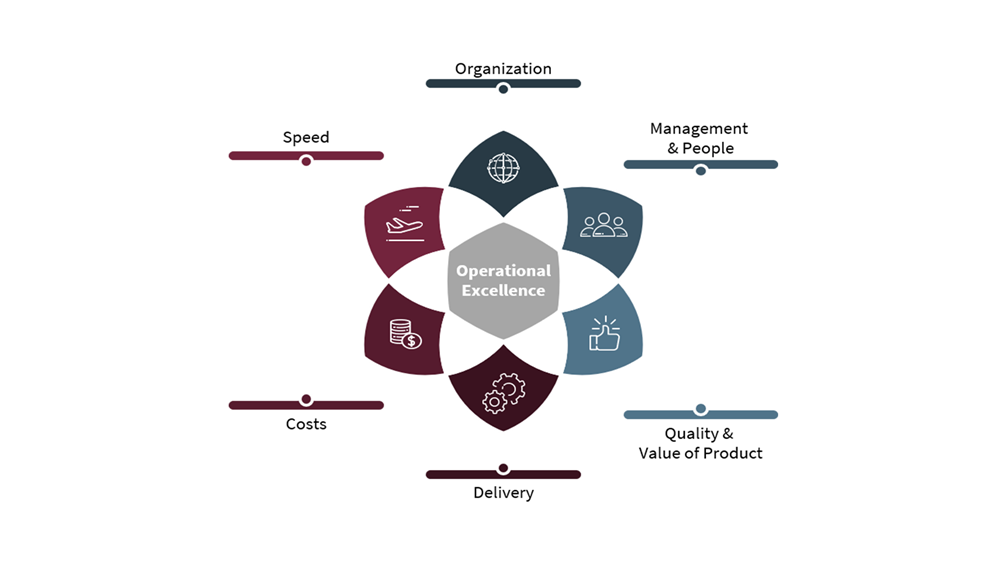

Operational excellence is a state of mastery and proficiency in executing business strategy. Operational excellence initiatives are those that result in improved operational efficiency, agility, and performance.

To maintain or build a competitive edge in a maturing market, ILS platforms should focus on initiatives to realise operational excellence in their business. Doing so will ensure they optimally allocate finite human and financial capital to value-creating activities.

Starting Point to Pursue Operational Excellence

To identify opportunities to deliver operational excellence for an ILS platform, it is important to consider the various lenses through which an ILS platform can be examined as potential starting points.

Organisation. An ILS platform can examine its enterprise architecture and the deployment of people to run or change the business, information flows within and beyond firewalls, and the use of tools and the infrastructure on which they are based to support business activities.

Management and people. Investor demand for new products and the flight to quality, among other industry trends, lead to questions as to whether an ILS platform is flexible and robust enough to meet changing requirements. Does the platform have the people with the right skillsets, experience in technology-driven approaches to deliver its strategy, and a culture embracing operational excellence? Is the management style and culture agile and able to stay ahead of the curve in meeting changing market demand? Does management empower employees to work autonomously to create and deliver innovative solutions? Are employees’ mindsets mission-driven and always focused on customer value?

Quality and value of product. An ILS platform should understand and communicate its value proposition, both internally and externally, and where it is positioned within the ILS value chain. The platform should assess whether its products are designed in a way that optimises value for its clients, investors, and cedents. It should ask if it is producing products of the quality that the client expects. Are investor reports high quality? Do the funds only invest in products as described in the risk appetite? Is the underwriting solid? Can claims be paid as quickly as expected?

Delivery. Do the business processes best position the organisation to deliver on its value proposition? Can certain processes be streamlined, outsourced, insourced, automated, or made redundant? Should certain areas the enterprise receive more focus and others be deprioritised, as they are either duplicate or non-critical to the product? Does the business have the right technologies in place for an optimal delivery model?

Costs. Efficiency gain is probably the best understood area of Operational excellence. It is closely related to delivery, as costs can be reduced by streamlining processes. Costs can also be optimised by managing a cost-efficient infrastructure set-up (e.g. a cloud set-up/optimising available computing power) and software sourcing.

Speed. Cedents increasingly expect platforms to have the ability to quickly and accurately process offers and deliver contracts. For their part, investors will come to expect timely valuation, near real-time delivery of event reports, and expedited collateral release.

How to Improve

As ILS platforms look to bolster their value propositions, an inexorable focus on operational excellence can itself be a competitive advantage. There are always fast followers who will try to copy the latest product developments or set up their own reinsurance vehicle. Operational excellence, by contrast, is not easy to copy and can create a true differentiator.

Synpulse is here as your ILS operational excellence partner and offers services dedicated to creating state-of-the art digital ILS operating platforms. To learn more about Synpulse and our offerings, please contact us directly. Also, stay tuned for upcoming insights on our ILS solutions.