-

Risk Assessment and Pricing

Methodical and technical competencies in risk assessment and pricing

-

Design and Implementation

Experienced in underwriting process design and implementation

-

Integrating External Data Sources

Expertise in systematically integrating external data sources

-

Pricing Models

Proven expertise in prevention of anti-selection and the transfer of underwriting insights into pricing models

Digital Underwriting

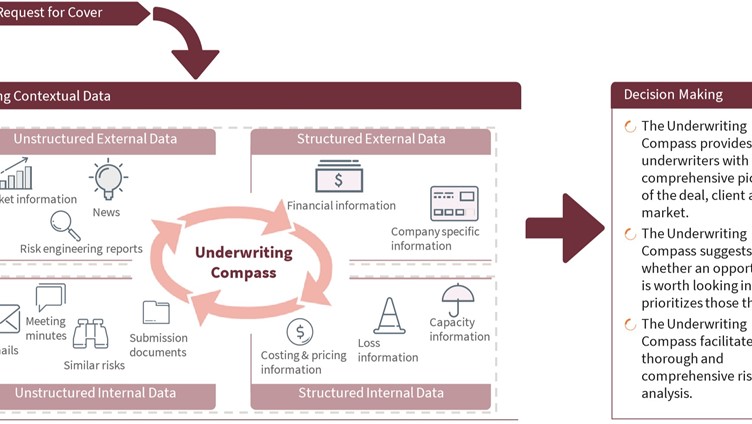

Automate labor-intensive and non-value adding underwriting activities and perform rule-based risk assessment in real-time. Go beyond traditional risk accepting and rejecting and focus on risk optimization to generate insights for your product and pricing management.

Are you asking yourself

- How can we automate labour-intensive underwriting activities and perform risk assessment based on rules real-time?

- How can we replace manual risk assessment with a synchronised and front-loaded digital process?

- How can we use external data sources in underwriting and switch from a one-time data collection to ongoing data recording and analysis?

- How can we focus on risk optimisation instead of simply accepting vs. rejecting risks to generate insights for product and pricing management?

What you will get from us:

- Outside-in challenge of your existing underwriting processes

- Reduction of media breaks and manual effort in the UW process

- Enhanced room for man oeuvre in the obtaining of information, increased efficiency in data collection and improved effectiveness in dealing with risk assessment

- Gaining experience in continuous risk optimisation and laying the base for dynamic pricing

- Improvement of the pricing process by using new data sources and widening of risk characteristics

Skillset