-

Idealisation of growth with WMC.

Readiness evaluation on exiting platforms, process and procedures, or risk management framework.

-

Concept and design.

Target an operating model design that leverages on existing infrastructure and gap analysis (gap breakdown and action item to close). Focus on regulatory compliance with risk assessment to ensure compliance with the principles of WMC on cross-border or suitability as well as AML/KYC rules defined under the scheme.

-

Planning.

Strategic plan to prioritise tasks or action items based on materiality, cost and effort, as well as resource and budget.

-

Transformation.

Implement and execute the transformation plan.

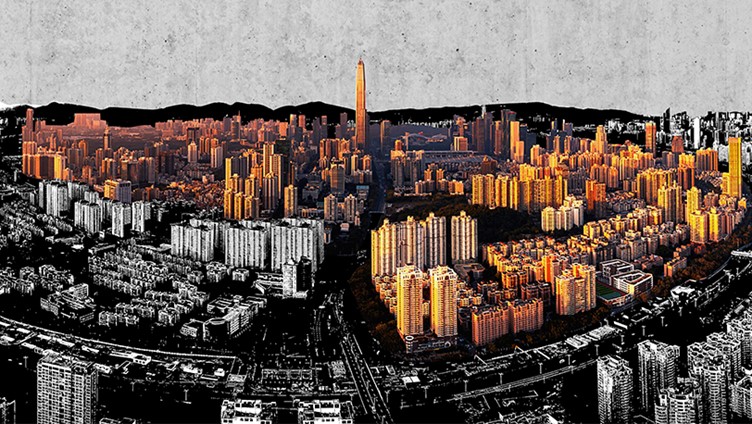

Wealth Management Connect for Greater Bay Area

Realise the potential of the Greater Bay Area financial hub with wealth management connect

Are you asking yourself

- How to serve the growing wealth in the Greater Bay Area?

- Are you setting up the right operating model for wealth management connect?

- What are the regulatory checkpoints for wealth management connect?

What you will get from us:

- Readiness evaluation report.

- TOM design (including effective and optimised regulatory and risk framework for WMC), with gap mapping (including proposed solutions).

- Implementation plan.

- The launch and upgrade of the WMC operating model.