Transform your anti-money laundering (AML) operations and discover how our expertise can support you in selecting, designing, and implementing AI/ML-based solutions that are cost-efficient, effective, and aligned with global standards.

Money laundering has become a global concern, fuelled by the rise of new methods, evolving typologies, sophisticated criminals, and control lapses. This alarming trend is estimated to range from USD 800 million to USD 3 trillion. As criminals constantly devise evasive techniques, driving up compliance costs and making traditional methods ineffective, banks are under immense pressure to find effective solutions to combat money laundering.

In this landscape, traditional Financial Crime and Compliance (FCC) operations struggle to keep up with the increasing transaction volumes, regulatory requirements, and industry competitiveness. Fortunately, AI and data analytics offers a solution to enhance FCC operations. These AI-enabled monitoring and surveillance solutions automate tasks, identify patterns, and swiftly detect suspicious activities. This can notably not only reduces compliance costs but also minimises disruptions to legitimate customers.

Shortcomings of traditional AML approaches

Traditional anti-money laundering (AML) methods, even with automated transaction monitoring (TM), suffer from excessive manual intervention, inefficiencies, errors, and a lack of contextual understanding. This means complex money laundering patterns may go undetected.

Organisations that rely on traditional AML approaches commonly face challenges such as:

Ensuring the solution has incorporated adequate measures to address such deficiencies can significantly enhance compliance operations.

Applications of AI/ML in AML operations

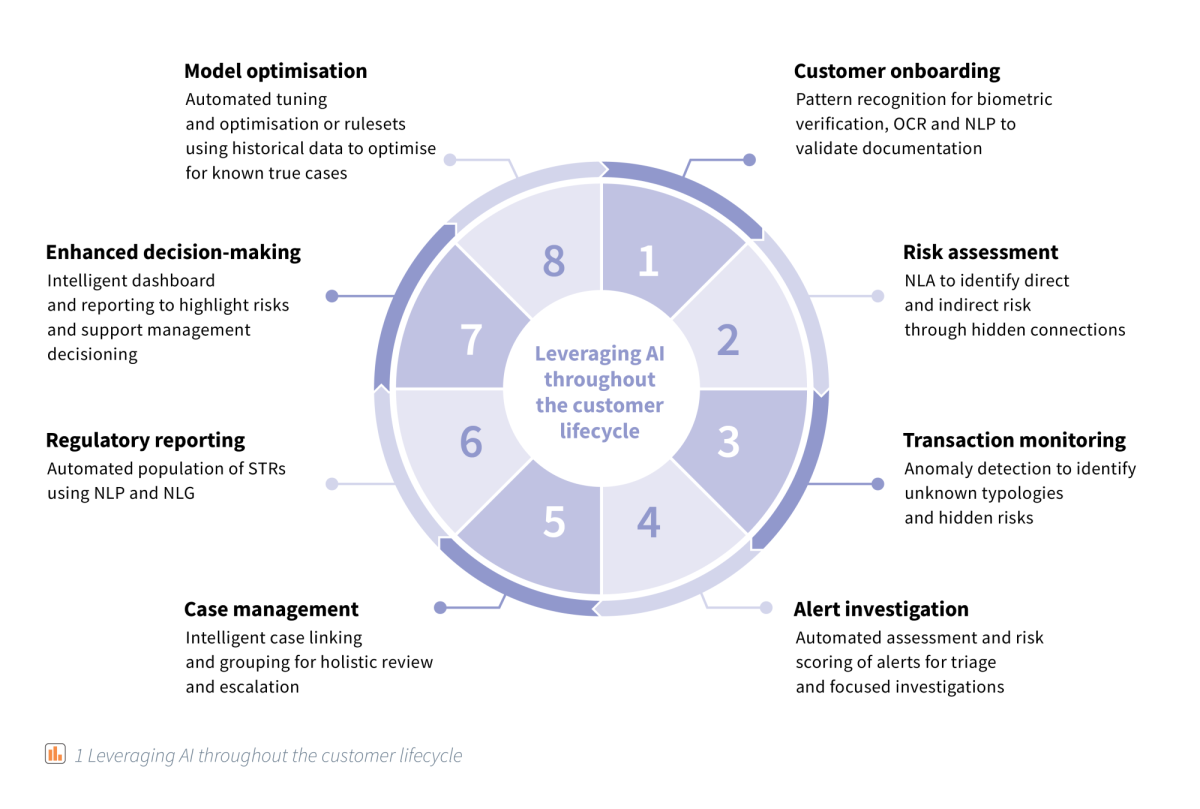

Leveraging artificial intelligence (AI), and other advanced technologies throughout the customer lifecycle, can significantly benefit AML operations with enhanced efficiency, improved accuracy in identifying suspicious activities, and better compliance with regulatory requirements. It is important to ensure proper data governance, address potential biases, and maintain human oversight to mitigate risks and ensure the ethical and responsible use of AI in AML operations.

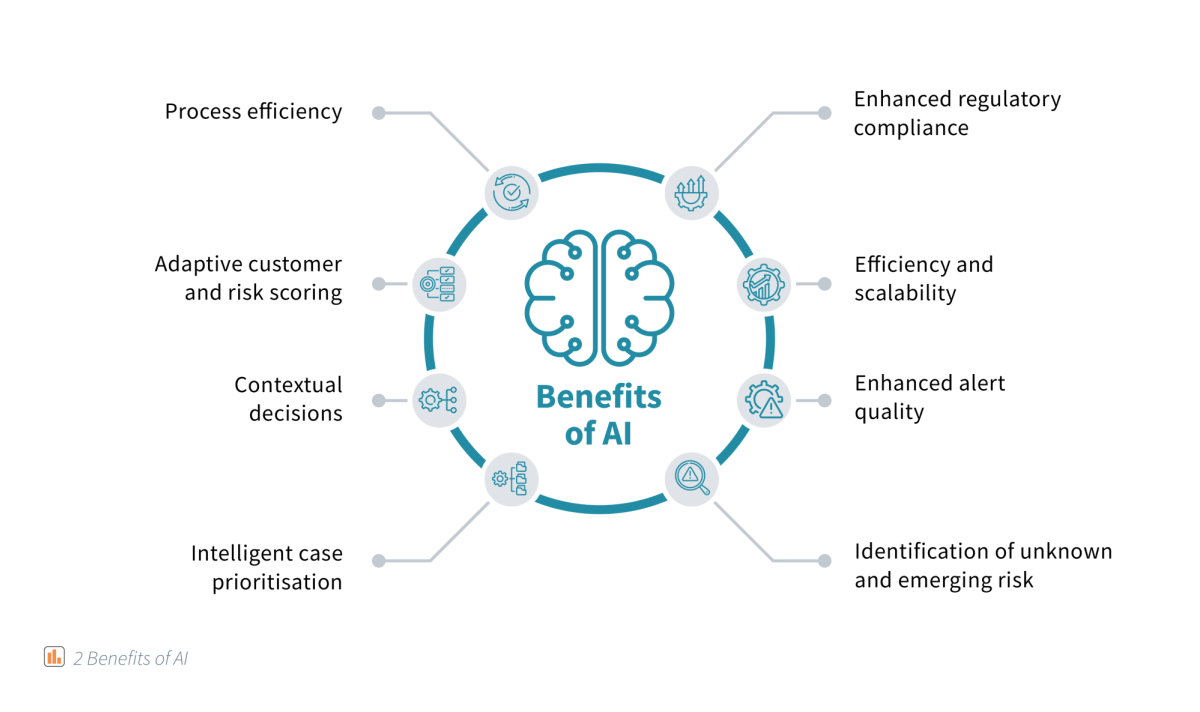

Benefits of incorporating AI/ML into AML operations

The rapid evolution of ML typologies and the sheer volume of transactions, along with the need to constantly redesign and recalibrate rules, has rendered conventional systems almost unusable in the current landscape. The complex and time-consuming nature of compliance operations increases the potential for lapses and the likelihood of substantial penalties. Hence, regulatory bodies encourage the adoption of automated systems to cope with the increasing complexity of modern AML. Thankfully, AI-driven AML tools offer efficient and expedient execution of essential tasks.

Use case: Empowering AML operations with an AI-driven solution

Client: A large retail bank facing multiple challenges in effectively identifying and preventing money laundering activities across its customer base.

Problem: The existing rule-based AML TM system generates a high number of false positives, placing excessive workload on the TM unit and resulting in a significant backlog of cases. Additionally, the manual tuning and rule design requirements have led to gaps in the overall AML risk coverage.

Solution and approach:

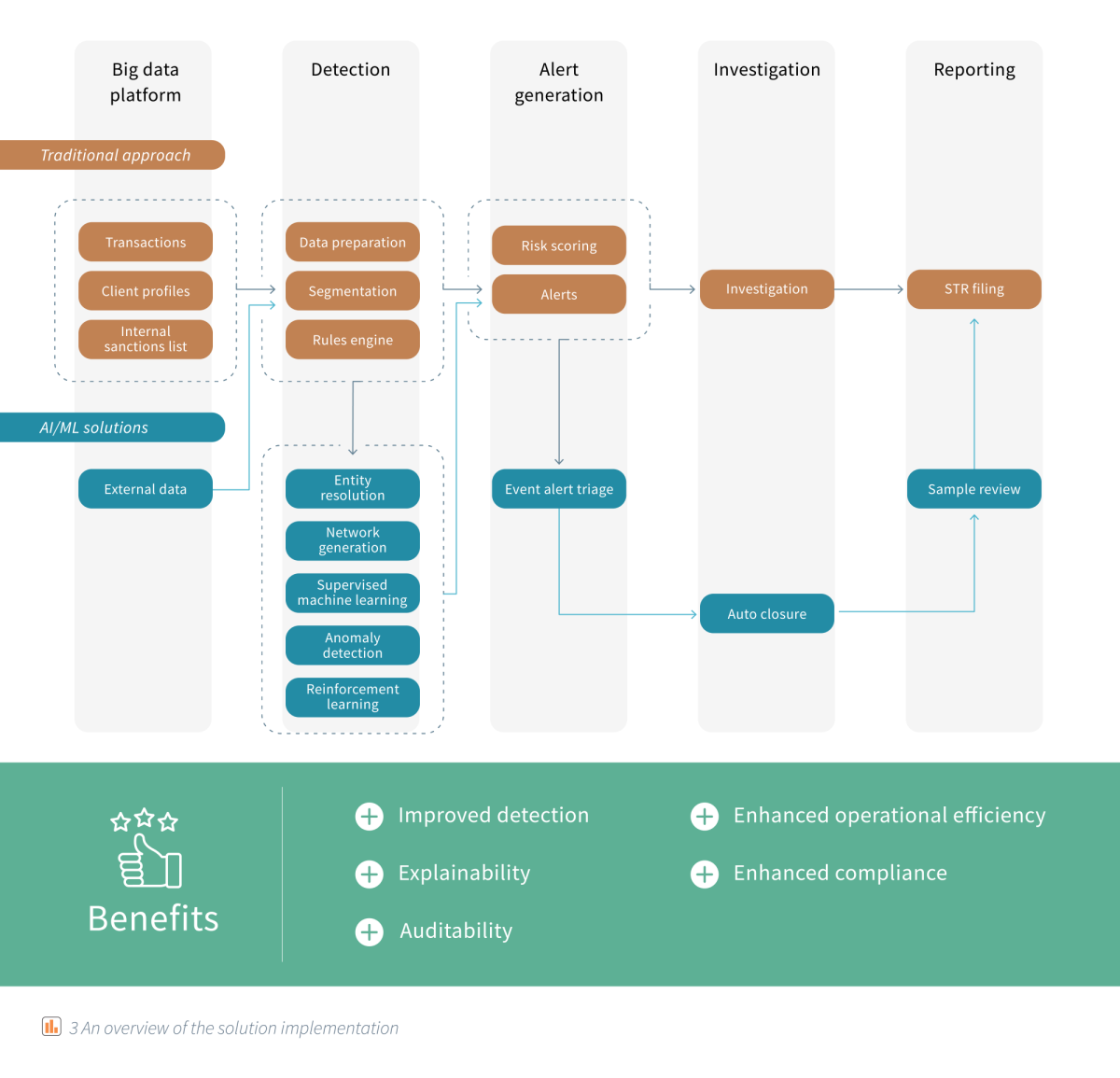

The bank implemented an AI-driven solution that combines several key components:

- Bespoke customer segmentation

- Customer profiling

- Detection rules engine

- ML-based detection

- Anomaly detection

- Probabilistic risk scoring

- Automated STR generation

- Entity resolution

- Network link analysis

- Customizable and automatable workflows

Outcome:

The use case demonstrates the successful application of an AI-driven solution to combat money laundering. The solution will provide the bank with multiple benefits in its AML TM operations, including:

- Enhanced effectiveness: The solution is a combination of supervised ML techniques for detecting known typologies, anomaly detection for identifying unknown risk indicators, and objective rules for enhanced detection accuracy. It also incorporates alert triage using probabilistic scoring to boost the likelihood of accurately identifying AML risks.

- Improved efficiency: The enhanced detection, coupled with the probabilistic scoring mechanism, significantly reduces the volume of false positive alerts. The intelligent case management capabilities also streamlined the handling of alerted cases, optimising the overall workflow.

- Straight-through processing: The solution leverages powerful aggregation capabilities, automating the process of gathering and consolidating relevant data from multiple sources. This automation reduces the manual effort required during the investigation and enables more streamlined and accurate analysis and quicker regulatory filing.

- Explainability: With a focus on transparency, the solution employs ML techniques that are not only effective but also inherently explainable. Providing the explainability in plain language enables users to gain insights into the factors that influence the model decision process and facilitates better investigations and decisions on alert disposition.

- Auditability: The solution maintains a comprehensive audit trail, tracking and documenting every change made within the system. This feature enhances accountability, facilitates forensic investigations, and ensures regulatory compliance by providing a transparent record of actions taken.

How we can help

By revamping your AML operations with the power of AI and data, you can significantly enhance detection capabilities and stay ahead of evolving money laundering activities. With that in mind, our comprehensive range of services is designed to support you in various critical areas:

- Solution selection: Our experienced team supports banks in selecting, designing, developing, and validating AI/ML-based solutions aligned with the regulatory guidance. We ensure the business objectives are achieved within given timelines.

- Data management: Our DMINABOX® data management suite can offer comprehensive tools and methodologies to streamline the design and implementation of data governance frameworks. Clients gain deep insights into their current data landscape, while our advanced algorithms analyse vast amounts of data, providing a thorough understanding of the existing data state.

- TOM design: With extensive banking experience, we understand our clients’ unique challenges. Combining expertise with cutting-edge AI technologies, we deliver customised solutions that enhance decision-making and operational efficiency.

- Extensive knowledge of AML/CFT regulations: With a strong grasp of AML/CFT-related topics in the APAC region, along with our deep understanding of global regulations, we can help you navigate the dynamic regulatory landscape and align with global standards.

Speak with our experts to explore how you can revolutionise your AML operations.