Within Asia, Singapore and Hong Kong are well-established financial centres, making them favoured destinations to build an external asset manager (EAM) business. The authorities in both centres endeavour to create favourable conditions for the wealth management industry.

Last year’s study by Synpulse showed that the Asian EAM scene gained momentum since the 2008 financial crisis. Our latest market assessment, described in this article, shows that Hong Kong, in particular, saw a number of new EAMs established in the last 12 months.

In the study, UBS estimated that assets managed by EAMs today are in the region of 3% in Hong Kong and 5% in Singapore. These figures are expected to grow significantly over the coming years.

Swiss private bank Julius Baer has the same view. In its report, the bank projected that in 2020, assets managed by EAMs in Asia will increase by more than 100% in volume to around USD 55 to 60 billion. The number of EAMs is, thereby, projected to increase by 25% for Singapore and 50% for Hong Kong and the average AUM by 60% for Singapore and 43% for Hong Kong, respectively.

Fundamentally, the expected growth in the external asset manager business can be attributed to the following factors:

- EAMs are not pressured to meet sales targets, which allows them to focus on the long-term success of a relationship and be fully aligned with their clients.

- Compared to relationship managers (RM), EAMs provide clients with a sense of stability, as they are less likely to change employers.

- EAMs typically spend more time with the client to make sure they understand their needs.

- EAMs are experts in providing the sophistication and specialisation required by ultra-high-net-worth (UHNW) clients or families.

A senior market player described EAM as:

“We believe that the EAM model is the future of wealth management, as it is neutral and unbiased. Contrasting the customer advisor at a bank, the EAM carries complete responsibility with respect to the client and is better-qualified, thanks to his or her experience.”

Another industry expert shares the same view:

“The financial industry is in a major re-orientation, which requires dedicated focus from all participants. The current market environment may distract in the near term, but the underlying growth prospects of the EAM segment remain solid in Asia.”

With increased client demands and regulatory influence, the EAM business has seen strong growth in Asia. However, external asset managers can only deal with the growth if they are supported by a custodian bank that fully understands their needs and has the capability to react. The vital partnership between the EAM and custodian bank has a great impact on the client satisfaction level, as detailed in our study last year.

Although custodian banks have developed the relevant guidelines in dealing with their customers, the complexity of client demands and ever-changing regulations require constant improvements on their end. Leading banks have started to not only comply with the current regulatory requirements but also embrace their top desire “customer centricity” and move from a product to a customer-centric organisation.

As such, the Synpulse market survey revealed that in the short term, custodian banks need to improve in two areas. The first is on their data management and transactional handling for regulatory purposes, whilst the second is on the complexity and duration of their client onboarding process.

“The biggest challenge is the increasing effort to onboard EAM clients.”

Focus on custodian banks

Compliance will be an even bigger burden with rising and ever-changing regulations, especially with the 1MDB case. Due to the increasing regulation, Asian private banks are becoming increasingly polarised in terms of the clients they serve. Moreover, the uncertainty and volatility in today’s markets make it difficult for custodian banks to provide any real value or advice to clients.

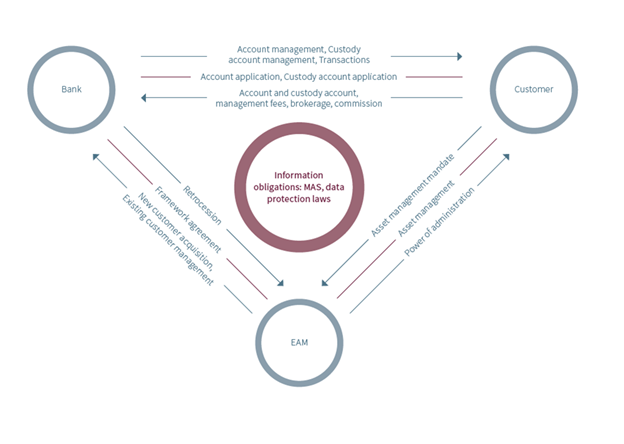

Hence, the need for EAM advisory services will continue to grow. Because of their size, EAMs find it difficult to achieve comprehensive coverage in the areas of compliance, legal, and operational risk aspects. This is especially the case in Singapore and Hong Kong, where the Monetary Authority of Singapore (MAS) and the Hong Kong Monetary Authority (HKMA) impose stringent requirements.

On one hand, this will lead to a consolidation of the market, and on the other, it will influence the business model of custodian banks. If we consider the increase in customer documentation requirements (know your customer) for example, custodian banks will have to meet various new standards in the areas of client data storage and transaction handling in the future.

The new standards of client data requirements worsen a prevailing problem for custodian banks (e.g., its long and complex onboarding processes). Insufficient prospect management structures and the lack of end-to-end digitalization, with a low first-time yield rate, have led to a lengthy onboarding process, poor customer experience, and even poor prospect conversion rates. Missing flexibility to cope with new regulatory requirements also causes high implementation costs and compliance risks.

An EAM desk head in Singapore emphasised that:

“The biggest challenge is the increasing effort to onboard EAM clients due to the complexity of client demands. Especially the South Asia market, with clients from Indonesia and Malaysia, is complex in terms of client onboarding. The challenge starts with retrieving necessary evidence of the source of wealth for some of the younger generation tycoons. Clients in the North Asia market seem to be less difficult in this aspect, with a well-documented source of wealth (e.g., entrepreneurs of IT startups).”

Thus, a robust client data management system for regulatory and risk (e.g., custodian core banking system) is one of the most critical functions that external asset managers require from custodian banks today. In the medium- to long-term period (>5 years), EAMs will require even more sophisticated functions from custodian banks, especially in the area of digital wealth management. This helps EAMs better cater to different client expectations and behaviour. This also reduces the need for manual processes.

“Only banks with enough scale and critical mass will be able to service EAMs in the future.”

Challenges on the road to digitisation

Across the industry, there is a consensus that digital wealth management has become imperative, but even the biggest industry players find it difficult to delineate its range and consequence. As initiatives and research continue to mature in this field, custodian banks no longer focus exclusively on client-facing online channels. In fact, adopting a holistic approach covering people, processes, systems, data, and even decision-making is the way forward.

With clients becoming more digitally inclined and globally connected, they are gradually exposed to new financial options and service models. This raises the clients’ expectations and their awareness of any offering and service gaps from their existing financial service providers.

For instance, EAMs require a comprehensive service package from custodian banks. The Synpulse study revealed that next to the brand and reputation and geographical reach of the custodian bank, EAMs ask for the following digital enhancements:

- State-of-the-art online features on one dedicated platform (one-stop-shop solution)

- Automated support in terms of risk controls (e.g., cross-border product suitability)

- Timely and marketable execution of all types of transactions

- Real-time product information and market data access

A senior market player confirmed the findings:

“Only banks with enough scale and critical mass will be able to service EAMs in the future. This is due to the high investment cost required for the state-of-the-art platform and regulatory driven compliance monitoring duties of financial institutions for some aspects of EAMs’ businesses.”

As such, custodian banks need to offer real-time online platforms with consolidation and ad-hoc reporting features, including transaction initiation. Solutions, which are integrated into their core banking system, are necessary. They should allow a quick response to market trends, provide external asset managers with the latest range of products and system features, and guarantee the best possible processing efficiency and process integrity.

In short, custodian banks have to provide a wide range of services, including administrative support to EAMs through an integrated service model. An EAM desk hHead in Singapore commented, “Regulatory constraints drive differentiated service models, which rely on larger and more sophisticated custodians. This makes it more difficult for smaller or boutique banks to stand out as custodians.”

“EAMs will most likely become more demanding and partner with banks that have a solid online offering in addition to the offline one.”

Optimal support for EAMs

The leading custodian banks have a choice to invest even further to significantly improve their EAM services:

- Direct access to the bank’s infrastructure through an EAM-friendly and secure platform

- Custodian bank’s care desk and EAM-specific client onboarding process

- Establish an automated, secure, and reliable connectivity between EAM, custodian bank, product providers, and financial markets for all clients’ financial transactions

The enhancement requires thorough process analysis between the business and information technology to plan the change management, the IT, and process changes. One of the points of focus should be the EAM onboarding process. This may require the redefinition, adaptation, and implementation of the underlying workflow within the bank’s IT platform.

The proposed solution requires custodian banks to:

- Remodel business processes and create a support function to enable full transactional capabilities for EAMs

- Enable automated data exchange between the custodian banks’ core banking platform and the EAM applications to keep client data and positions in sync to avoid (manual) double maintenance on either side

- Provide the external asset manager employee-level remote access to the custodian banks’ platform through a highly secured and restricted gateway to ensure that data will not be compromised

Small players with the desire to expand their EAM service model may find it difficult to allocate enough budget to heavily invest in a dedicated EAM platform. They can still improve their services towards EAM in various ways.

For instance, when setting up a dedicated EAM desk that assists the EAM with highly specialised front office staff with knowledge and experience in EAM client onboarding and servicing. There are significant functional differences, both from an operational and system requirement aspect, between a normal and an EAM client. This requires a dedicated and specifically trained team.

Another option to improve the service offering is through the bank’s internet banking (IB) platform instead of direct access to the more sophisticated core banking platform. Many Asian banks have adapted their retail IB offering for their wealth clients.

For EAMs, banks can take it one step further by augmenting their IB from a pure business-to-customer (B2C) to a business-to-business (B2B) platform. Different workflows have to be designed for EAMs to allow for holistic portfolio and transaction views over a selection of clients and exception handling during investment transactions. A distinct notification framework may be added to identify and address EAM requests or alerts due to exceptions.

Allowing external asset managers to trade on behalf of their clients via the IB platform is already a differentiator in the Asian market and is appreciated by EAMs. It also reduces the workload of RMs, who typically execute according to EAMs’ instructions. However, it requires a properly defined business and IT architecture to ensure the IB platform can cater to the different EAM use cases (i.e., specific EAM user identification and EAM workbench with more complex reports).

“We believe that the EAM model is the future of wealth management.”

Conclusion

At a time when service levels are decreasing at custodian banks due to the regulatory spotlight, all companies will not only have to seriously re-look at their business models but also comply with new regulations as efficiently as possible.

A senior market player predicted:

“EAMs will most likely become more demanding and partner with banks that have a solid online offering in addition to the offline one. However, in the long term, the bank will potentially charge EAMs for using their platform rather than remunerating them in the form of retrocessions.”

To seize the moment, custodian banks should be encouraged to invest in their operating models to leverage their external asset manager business. Small players who manage to increase their market share stand to gain significant returns on investment for system enhancements from the recurrent revenue stream. On the other hand, bigger players who manage to build up an integrated service model through an experienced and specialised EAM desk and a modern EAM IT platform will become true market leaders.