Loading Insight...

Insights

Insights

NEOINSURANCE® is Synpulse's new business model for the insurance industry, combining the ecosystem paradigm with a relentless focus on customer needs and convenience.

Identifying and meeting customer needs is the key to success in business. Driven by social and technological developments, the needs and demands of insurance customers are changing rapidly and irreversibly. Rather than being treated separately, insurance is now a core element of the combination of goods and services that meet specific needs.

This is the heart of the ecosystem concept. An automobile can fulfil the mobility needs of its users, and the insurance required to operate the car safely and legally is just as integral as the tyres or the steering wheel. In this approach, insurance becomes seamlessly integrated into the mobility ecosystem, as with many others – health, retirement, housing, travel, and so on. Customer demand for this seamless integration is already revolutionising insurance delivery.

This new way of connecting customer needs with insurance is enabled by technological development and data science capabilities, creating conditions for the rise of ecosystems. In an ecosystem network, insurers cooperate with strategic partners, forging new, collaborative value chain models that complement traditional value propositions.

The future is here, and insurers must react to these changes. The precise course of action will rely on the insurer’s market position and strengths. Our whitepaper explores the roles an insurance company can play in the NEOINSURANCE® model to reap transformational benefits, outlining key strategies – whether they reflect a universal or a more focused approach.

We have developed the NEOINSURANCE® model as a way of meeting the challenges and pressures of today's marketplace and turning them into strategic opportunities. By defining their roles within the emerging ecosystems and systematically working to claim and develop these roles, existing insurers can play to their strengths while building the capabilities necessary to achieve their goals.

Silvan Stüssi, Synpulse

1 | The meaning of insurance ecosystems

An insurance ecosystem is an interconnected group of service providers and offerings centred on the customer need. It aims to rapidly and efficiently meet the components of a need through convenient and seamless customer experiences. This significantly differs from traditional insurance, where self-contained companies perform functions from data administration to the customer interface along with core risk management.

Sounds interesting? Download the full whitepaper on NEOINSURANCE®

2 | The ecosystem imperative

Ecosystem concepts have been in insurance for some time, appearing in strategy decks and industry gathering keynote speeches. Now the idea has exploded. Several trends in markets and technology have coalesced to create the ecosystem imperative.

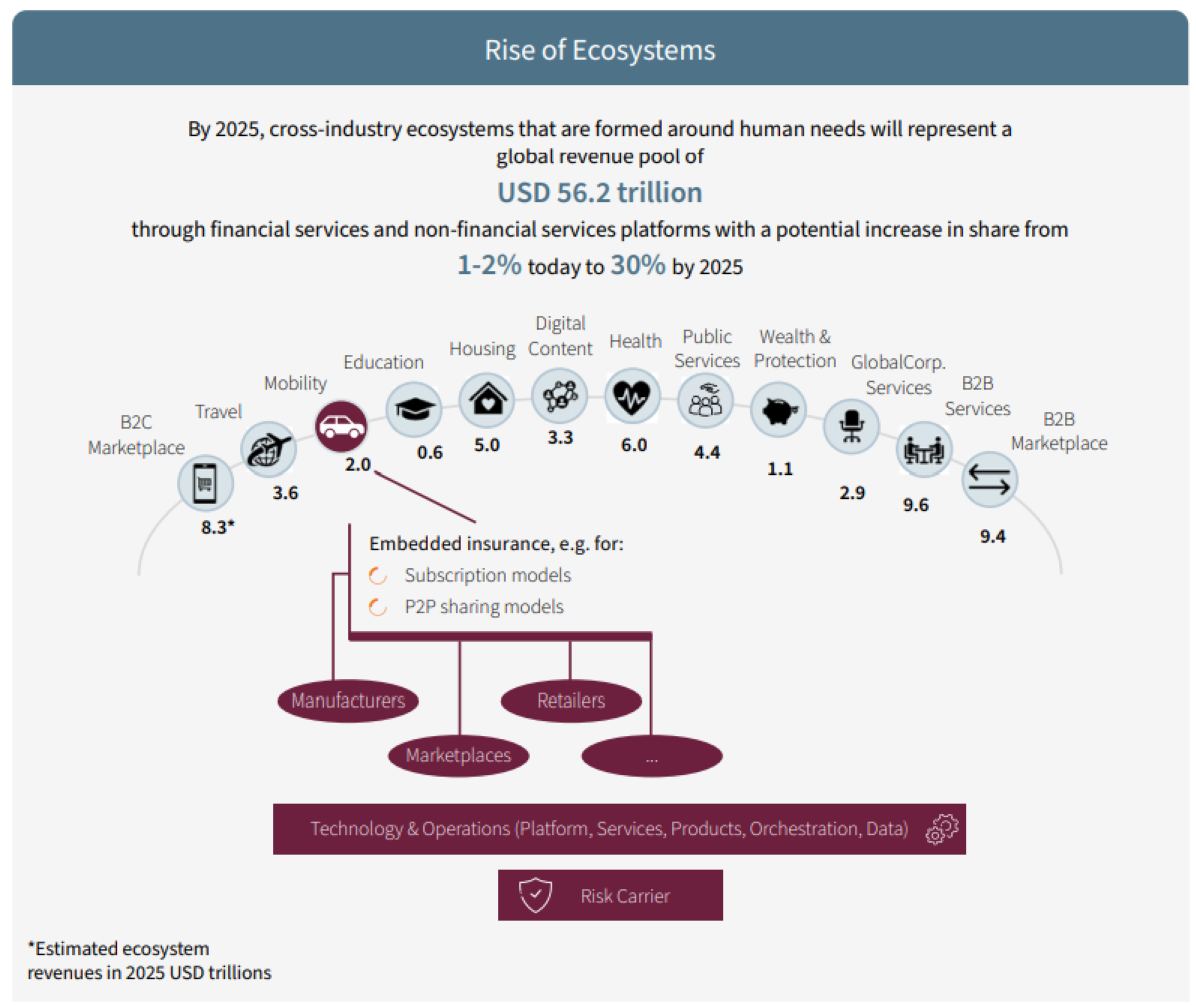

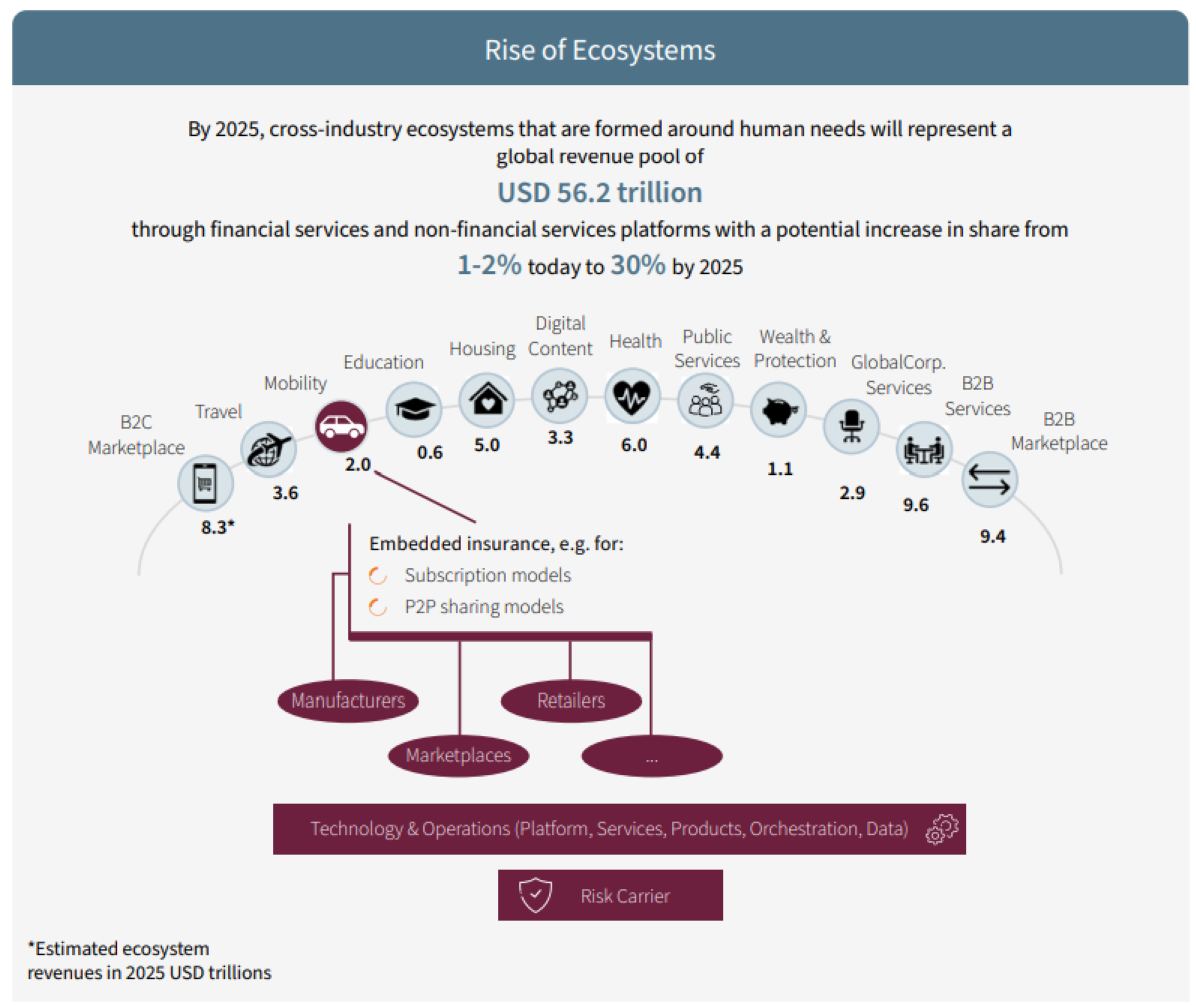

In other words, the transition towards this kind of market re-organisation is irreversibly underway, and for insurers, the imperative is to adapt or fail. In fact, current estimates indicate that in 2025, ecosystems will account for up to 30% of global revenues, equalling to USD 56.2 trillion*. This revenue pool is up for grabs, with many traditional insurers in no position to lay special claims.

Source: McKinsey Quarterly 2017 Number 3, IHS World Industry Service, Panaroma by McKinsey, and Discovermarket

3 | A new starting position in the race for the customer interface

A 2021 insurance study by Synpulse, Zühlke, and ZHAW reveals the challenges faced by the insurance sector and underlines the power of the ecosystem imperative. The study is based on interviews with five CEOs and eight executive committee members from ten leading P&C and life insurers, covering 80% of the Swiss P&C market and 70% of the Swiss life insurance market in 2021.

The study’s model – confirmed by the survey data – shows that the insurance industry must set the course on

the individual business segment level, as the perception of the customer differs widely across the corresponding ecosystems. The study is able to corroborate this in high-level discussions with industry representatives.

However, it also shows that the situation in this space is still not much differentiated. Most players have not committed to a path forward yet, leaving much room – and also creating great urgency – for setting a strategic course, which becomes possible within the framework of a NEOINSURANCE® approach.

The study can be found here.

These insights have led Synpulse to a number of core beliefs that guide our approach and form the backbone of a strategy that can help insurers prepare and thrive in this new world.

4 | Synpulse core beliefs

NEOINSURANCE® is a customer-centric model. It demands change driven by customer expectations and enabled by technological and organisational innovations – and not vice versa. This may sound trivial, but it bears remembering.

Digitalisation, big data, AI and all the other present and future technological tools must, in business, never be seen as ends in themselves. They must always meet and anticipate customer needs. The key trend in NEOINSURANCE® business models is the customer demand for convenience. Technological and data developments merely power a unique customer experience.

There are two principles where the ecosystem imperative is derived, the Synpulse core beliefs are conceived, and the NEOINSURANCE® model emerges, namely:

- Customer centricity emphasising convenience

- The possibilities of current and future technology

Download the entire whitepaper to learn about the Synpulse core beliefs.

5 | The requirements of the NEOINSURANCE® company

This lay of the land – customer expectations, technological possibilities, ecosystem imperative – and the beliefs it engenders paint a stark picture, from which the contours of a new business strategy become visible. This allows the formulation of demands from a customer's perspective and the requirements for a NEOINSURANCE® company operating in or orchestrating an ecosystem.

Moreover, this creates a set of challenges across business dimensions for insurers wishing to reap the benefits of this new paradigm. These requirements put a heavy burden on many of today’s insurers. They have not had a firm reason to move in this direction along any of the dimensions, as the traditional business models suffice and turn adequate profits.

Any pinches felt from encroaching ecosystem orchestrators (e.g., car manufacturers) or nascent disruptors can lead to insurers being less likely to start a big transition, as such an undertaking would bind resources needed to fend off threats and protect existing business models.

This can go well for a while. But the new world is coming – if it is not here already – and today’s insurers must find their niche. The NEOINSURANCE® operating model introduces two strategies to achieve this. Moreover, as shown in the aforementioned study,[1] measures may well be taken on the level of a segment or product rather than on a company-wide basis.

One strategy calls for concentration on the main insurance competency, where the potential added value is greatest. Handling and transforming the risk are the core components of the ecosystem that take over a large part of interfacing with end customers, whereas marketing, sales and similar front-facing units might be retooled or pared back.

Similarly, IT might be outsourced to varying degrees, as customer data and other IT functions enter the ecosystem’s cloud. The insurer concentrates on its main function, handling and transforming risk, and embedding it in a number of ecosystems. This is called the Focused Strategy.

In contrast, the Universal Strategy calls for insurers to cast a wider net, remaining independent as long as possible or taking the role of ecosystem orchestrator. When insurers choose to cover all aspects of the value chain to meet changing customer demand, end to end (E2E) excellence in all areas is required.

In addition, insurers can specialise parts of the value chain and offer services to other insurers. This works best when the ecosystem is insurance adjacent. An example would be pension and life, where customers might expect an insurance company to be in the lead, as opposed to personal mobility, where they would expect a car manufacturer.

Furthermore, in this niche, traditional insurance business models remain viable longer, as tapping the opportunities of the niche requires specific skills and competencies (e.g., commercial insurance) possessed by insurers.

Does the NEOINSURANCE® operating model pass reality check? Download the full whitepaper to learn more about the operating model.

Our conclusion for the insurance industry

The insurers’ periphery is open to disruption. This includes functions traditionally believed integral to any insurer, such as distribution, administrative services, and data efficiency. In these areas, the shift is already happening, and nothing will stop it. Insurers must prepare for this new world. Those who do so with a systematic approach, a clear understanding of the new landscape, and a set of concrete goals will gain a significant advantage.

If you, too, would like to prepare for this new world, we are here to guide and support you. We can help you gain advantage with the opportunities of our new NEOINSURANCE® model.

NEOINSURANCE® is Synpulse's new business model for the insurance industry, combining the ecosystem paradigm with a relentless focus on customer needs and convenience.

Identifying and meeting customer needs is the key to success in business. Driven by social and technological developments, the needs and demands of insurance customers are changing rapidly and irreversibly. Rather than being treated separately, insurance is now a core element of the combination of goods and services that meet specific needs.

This is the heart of the ecosystem concept. An automobile can fulfil the mobility needs of its users, and the insurance required to operate the car safely and legally is just as integral as the tyres or the steering wheel. In this approach, insurance becomes seamlessly integrated into the mobility ecosystem, as with many others – health, retirement, housing, travel, and so on. Customer demand for this seamless integration is already revolutionising insurance delivery.

This new way of connecting customer needs with insurance is enabled by technological development and data science capabilities, creating conditions for the rise of ecosystems. In an ecosystem network, insurers cooperate with strategic partners, forging new, collaborative value chain models that complement traditional value propositions.

The future is here, and insurers must react to these changes. The precise course of action will rely on the insurer’s market position and strengths. Our whitepaper explores the roles an insurance company can play in the NEOINSURANCE® model to reap transformational benefits, outlining key strategies – whether they reflect a universal or a more focused approach.

We have developed the NEOINSURANCE® model as a way of meeting the challenges and pressures of today's marketplace and turning them into strategic opportunities. By defining their roles within the emerging ecosystems and systematically working to claim and develop these roles, existing insurers can play to their strengths while building the capabilities necessary to achieve their goals.

Silvan Stüssi, Synpulse

1 | The meaning of insurance ecosystems

An insurance ecosystem is an interconnected group of service providers and offerings centred on the customer need. It aims to rapidly and efficiently meet the components of a need through convenient and seamless customer experiences. This significantly differs from traditional insurance, where self-contained companies perform functions from data administration to the customer interface along with core risk management.

Sounds interesting? Download the full whitepaper on NEOINSURANCE®

2 | The ecosystem imperative

Ecosystem concepts have been in insurance for some time, appearing in strategy decks and industry gathering keynote speeches. Now the idea has exploded. Several trends in markets and technology have coalesced to create the ecosystem imperative.

In other words, the transition towards this kind of market re-organisation is irreversibly underway, and for insurers, the imperative is to adapt or fail. In fact, current estimates indicate that in 2025, ecosystems will account for up to 30% of global revenues, equalling to USD 56.2 trillion*. This revenue pool is up for grabs, with many traditional insurers in no position to lay special claims.

Source: McKinsey Quarterly 2017 Number 3, IHS World Industry Service, Panaroma by McKinsey, and Discovermarket

3 | A new starting position in the race for the customer interface

A 2021 insurance study by Synpulse, Zühlke, and ZHAW reveals the challenges faced by the insurance sector and underlines the power of the ecosystem imperative. The study is based on interviews with five CEOs and eight executive committee members from ten leading P&C and life insurers, covering 80% of the Swiss P&C market and 70% of the Swiss life insurance market in 2021.

The study’s model – confirmed by the survey data – shows that the insurance industry must set the course on

the individual business segment level, as the perception of the customer differs widely across the corresponding ecosystems. The study is able to corroborate this in high-level discussions with industry representatives.

However, it also shows that the situation in this space is still not much differentiated. Most players have not committed to a path forward yet, leaving much room – and also creating great urgency – for setting a strategic course, which becomes possible within the framework of a NEOINSURANCE® approach.

The study can be found here.

These insights have led Synpulse to a number of core beliefs that guide our approach and form the backbone of a strategy that can help insurers prepare and thrive in this new world.

4 | Synpulse core beliefs

NEOINSURANCE® is a customer-centric model. It demands change driven by customer expectations and enabled by technological and organisational innovations – and not vice versa. This may sound trivial, but it bears remembering.

Digitalisation, big data, AI and all the other present and future technological tools must, in business, never be seen as ends in themselves. They must always meet and anticipate customer needs. The key trend in NEOINSURANCE® business models is the customer demand for convenience. Technological and data developments merely power a unique customer experience.

There are two principles where the ecosystem imperative is derived, the Synpulse core beliefs are conceived, and the NEOINSURANCE® model emerges, namely:

- Customer centricity emphasising convenience

- The possibilities of current and future technology

Download the entire whitepaper to learn about the Synpulse core beliefs.

5 | The requirements of the NEOINSURANCE® company

This lay of the land – customer expectations, technological possibilities, ecosystem imperative – and the beliefs it engenders paint a stark picture, from which the contours of a new business strategy become visible. This allows the formulation of demands from a customer's perspective and the requirements for a NEOINSURANCE® company operating in or orchestrating an ecosystem.

Moreover, this creates a set of challenges across business dimensions for insurers wishing to reap the benefits of this new paradigm. These requirements put a heavy burden on many of today’s insurers. They have not had a firm reason to move in this direction along any of the dimensions, as the traditional business models suffice and turn adequate profits.

Any pinches felt from encroaching ecosystem orchestrators (e.g., car manufacturers) or nascent disruptors can lead to insurers being less likely to start a big transition, as such an undertaking would bind resources needed to fend off threats and protect existing business models.

This can go well for a while. But the new world is coming – if it is not here already – and today’s insurers must find their niche. The NEOINSURANCE® operating model introduces two strategies to achieve this. Moreover, as shown in the aforementioned study,[1] measures may well be taken on the level of a segment or product rather than on a company-wide basis.

One strategy calls for concentration on the main insurance competency, where the potential added value is greatest. Handling and transforming the risk are the core components of the ecosystem that take over a large part of interfacing with end customers, whereas marketing, sales and similar front-facing units might be retooled or pared back.

Similarly, IT might be outsourced to varying degrees, as customer data and other IT functions enter the ecosystem’s cloud. The insurer concentrates on its main function, handling and transforming risk, and embedding it in a number of ecosystems. This is called the Focused Strategy.

In contrast, the Universal Strategy calls for insurers to cast a wider net, remaining independent as long as possible or taking the role of ecosystem orchestrator. When insurers choose to cover all aspects of the value chain to meet changing customer demand, end to end (E2E) excellence in all areas is required.

In addition, insurers can specialise parts of the value chain and offer services to other insurers. This works best when the ecosystem is insurance adjacent. An example would be pension and life, where customers might expect an insurance company to be in the lead, as opposed to personal mobility, where they would expect a car manufacturer.

Furthermore, in this niche, traditional insurance business models remain viable longer, as tapping the opportunities of the niche requires specific skills and competencies (e.g., commercial insurance) possessed by insurers.

Does the NEOINSURANCE® operating model pass reality check? Download the full whitepaper to learn more about the operating model.

Our conclusion for the insurance industry

The insurers’ periphery is open to disruption. This includes functions traditionally believed integral to any insurer, such as distribution, administrative services, and data efficiency. In these areas, the shift is already happening, and nothing will stop it. Insurers must prepare for this new world. Those who do so with a systematic approach, a clear understanding of the new landscape, and a set of concrete goals will gain a significant advantage.

If you, too, would like to prepare for this new world, we are here to guide and support you. We can help you gain advantage with the opportunities of our new NEOINSURANCE® model.