The article discusses the impending transition in the UK's trade settlement processes from T+2 to T+1. It highlights the drivers behind this shift, the need for process re-engineering, data quality improvements, and the potential role of technologies like DLT.

With the imminent release of research and findings from the HM Treasury’s Accelerated Settlement Taskforce, it is time for UK firms to act regarding transforming their settlement processes from T+2 to T+1.

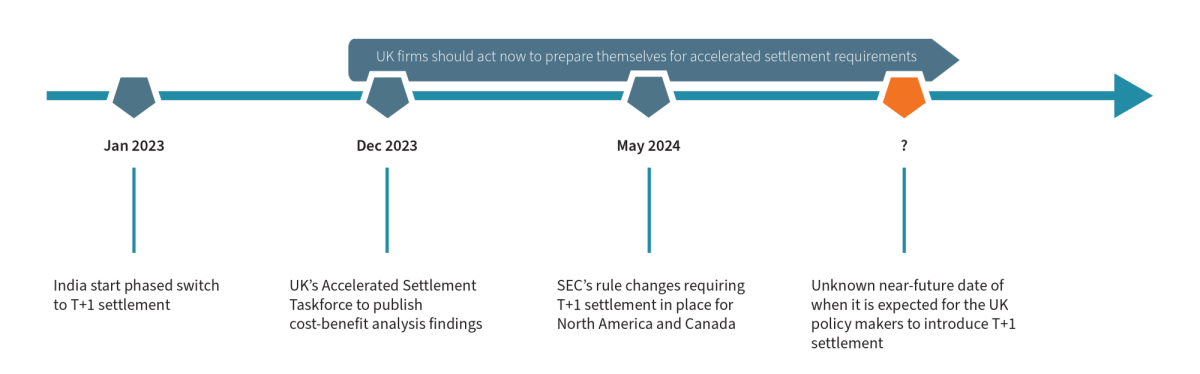

The UK’s HM Treasury set up the taskforce to specifically investigate accelerated settlement times in response to the US SEC’s rule changes effective May 2024. European markets will be motivated to implement T+1 settlement to remain competitive with the US and Canada markets, as well as India, which saw a switch earlier this year. There will be an opportunity to leverage lessons learned from the other markets’ acceleration in settlement times. However, each market will have its own complexities and challenges, not discounting the individual firms’ nuances.

Figure 1 below shows the timeline of the recent transition to T+1 for some major markets and highlights that the UK will likely be following in the not-so-distant future.

Considering more than GBR 20 billion is spent on trade processing every year (1), firms should actively look to move to a T+1 strategy. This will help to reduce market risk, lower margin costs and be a catalyst for operational excellence.

🔍 What's covered in the full article:

- Understanding the imperative shift to T+1 settlements

- Navigating operational overhaul for accelerated timelines

- Revolutionizing data quality for streamlined processes

- Embracing the future with DLT and its considerations

- Synpulse's expertise and strategies for a smooth transition

For a detailed understanding of these key areas and proactive steps towards adapting to these changes, access the full article PDF now.

The shift from T+2 to T+1 trade settlement is a pivotal moment for the UK banking industry. While it presents significant challenges, it also offers an opportunity for UK banks to enhance their competitive position in the global financial market.

Our team is ready to guide you through this transformational journey. Contact us for tailored solutions and expert guidance to futureproof your business in this dynamic landscape.