In our first article, we described the reasons why an underwriting workbench is the Formula 1 car of underwriting process systems. You want an underwriting workbench. But how do you choose the right configuration for your systems – soft or medium tires for the most efficient underwriting solution for your business?

Many insurers and reinsurers have business cases for individual process development. While short-term, tactical fixes can be used to evolve operations, in strategic terms these plaster-and-bandage improvements will never achieve the advances made possible by a rethink of the entire underwriting operating model. The cost entailed in an inefficient model informed rather than driven by data calls for a more sturdy and reliable solution – a solution enabled by automated workflows, machine learning and advanced data analytics.

As explored in a previous article, this is where the underwriting workbench comes into its own. If a carrier decides to implement a workbench solution, the most pressing question is how? This article lays out the steps involved through the process of selecting and implementing an underwriting workbench, and important things to consider along the journey.

The high-level motives for underwriting transformation include (but are not limited to):

- Business requirements (functional and non-functional)

- The maturity of the organisation and its IT architecture

- Integrations with internal and external systems

- Configuration for users’ needs including the insurer’s standards

- Scalability (e.g. lines of businesses, regions, frequencies, etc.)

- Budget

- Technical requirements (i.e. performance, stability, security, etc.)

Ideal where feasible: a “to-be” process design and process standardisation

The first step towards implementing an underwriting workbench is to lay out the ‘as is’ and identify inefficiencies and bottlenecks within the current operating model. One example of this type of inefficiency would be a typical part of a submission process, relying heavily on email, and document versioning and internal systems (e.g. a policy administration system (PAS)).

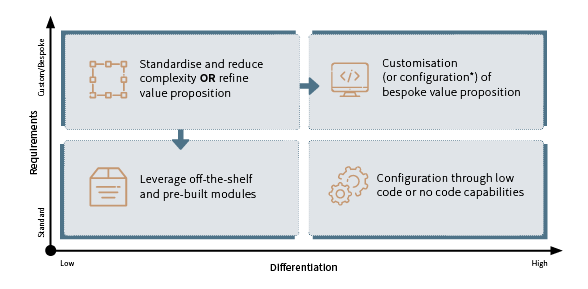

Once the pain points of the current model have been teased out and the carrier wants to leap forward with a future-fit solution, they face a choice in approach:

- Either a ‘to-be’ operating model can be designed that eliminates pain points and reflects the ideal way for the business to function (in which case vendor selection will be focused on finding a solution that can be customised or configured to best fit the design, considering low-code/no-code and custom-built solution providers as well as off the shelf), or

- A standard off the shelf solution can be sought that largely redefines the to-be processes to be adhered to.

While option 2 is often quicker and cheaper, it has the downside that the organisation needs to change their processes to those defined by the vendor, which can be disruptive to business as usual and requires acceptance from those affected. For either approach, standardising current processes as far as possible and eliminating ‘bad’ processes that are particularly clunky or nonsensical will help make digitalisation easier.

Download our entire factsheet and continue reading

We gathered even more insights for you and put them in our factsheet "How to Implement the Right Underwriting Workbench". Click to continue reading and download the whole factsheet for free.

In the factsheet, we cover an overview of different types of solutions in the market, their pros, and cons.

How can Synpulse’s experience and market intel help you make the best decision?

Synpulse combines insurance industry and technical expertise with delivery excellence, making it the partner of choice for underwriting workbench implementations. With experience working with large commercial and speciality insurance and reinsurance clients in the London market and around the globe, the company is well positioned to meet local needs and challenges with best-in-class solutions.

Synpulse understands where you want to make your underwriting model faster and slicker:

- A structured approach will be used to assess your current operating model, with approachable consultants with a ‘one team’ attitude consolidating and clarifying your current ways of working through detailed documentation.

- Thanks to experience acquired from being on the inside track of digital transformation initiatives with some of the biggest (re)insurance players globally, Synpulse can help you articulate your requirements and build your future vision.

Synpulse will help you execute a successful transformation project.

- Synpulse has extensive experience in insurance platform evaluations (off the shelf products, custom builds as well as low code/no code platforms).

- Synpulse owns a proven vendor evaluation framework, providing a structured, independent and flexible approach.

- For over 25 years, Synpulse has built relationships with established technology providers, serving as a reliable, entrepreneurially-minded facilitator when clients partner with start-ups. Synpulse’s technology powerhouse – Synpulse 8 – houses extensive software and data engineering expertise and proprietary SDK frameworks for faster and world-class solution design development and advisory services.

- Synpulse has experts in business analysis, technical design and project management to provide the structure and organisation required to run a successful workbench implementation.

- Synpulse is committed to delivering lasting solutions within change management programmes, and trains your teams to work with confidence in the digitalised world.

In our next article, we’ll be revealing more about the process of vendor selection and implementation and key do’s and don’ts. Sign up here to get this sent straight to your inbox.

If you’re looking to accelerate your journey to become a Bionic Underwriter of the Future, please get in touch with one of our consultants via LinkedIn!