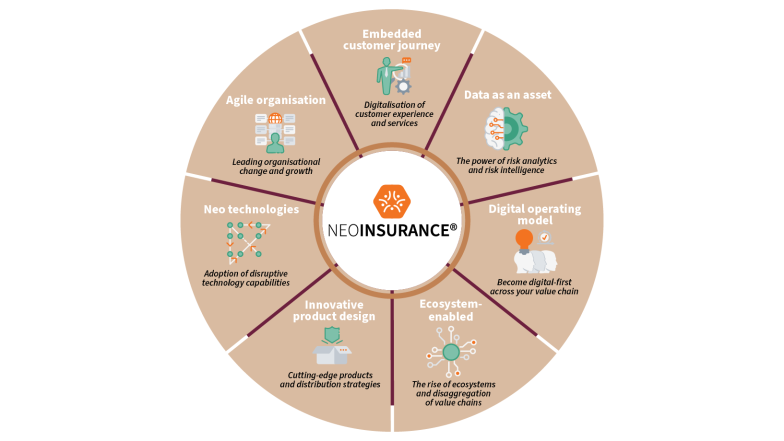

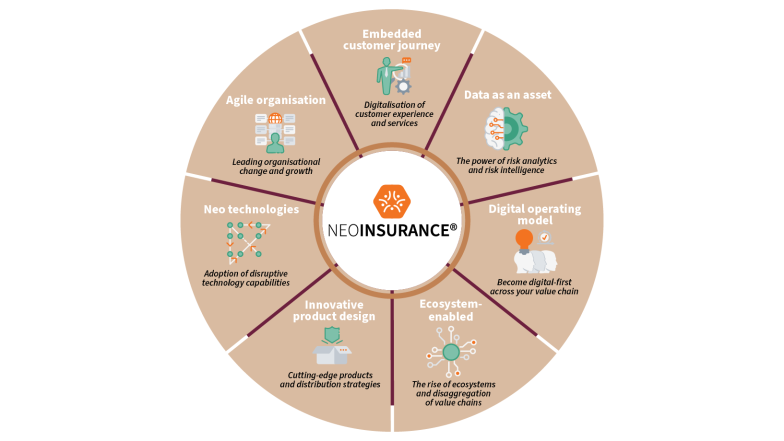

NEOINSURANCE

With the Synpulse NEOINSURANCE® framework, methodology, assets and deliverables, we provide our customers a hands-on toolbox to increase their NEOINSURANCE® readiness and maturity.

Our core beliefs

-

Core belief 4

Ecosystem-enabled

Value chains become more integrated and embedded. New products, services, and solutions are provided through collaboration or even co-opetition of different stakeholder groups. B2B2B or B2B2C ecosystems, platforms, and marketplaces are created to collect, augment, and share data and information for joint value creation.

-

Core belief 7

Agile organization

Transformational, sustainable change and growth are based on a strong and constant focus on empowering and developing your workforce. Attracting and retaining the right talents as well as fostering a culture of organisational agility and foresight will provide the operational foundation for an insurer to forge ahead and act as a shield against uncertainty and digital disruption.

Service offerings

With our best-in-class NEOINSURANCE® artifacts portfolio, we support our clients on their strategic transformation journey to become a key player in the Embedded Insurance playground.

Are you asking yourself:

- As an insurer I want to play an integral part in the Business Ecosystems and offer augmented insurance offerings and experiences in co-opetitive partnership models and to retain access to the customer interface

- As an insurer I want to be supported in the shaping of my target NEOINSURANCE® role

- As an insurer I want to sustainably increase my NEOINSURANCE® readiness and maturity level

- As an insurer I want to identify optimisation potentials in my NEOINSURANCE® target state and role

- As an insurer I want to define a strategic NEOINSURANCE® Transformation Roadmap (short-, mid-, long-term) to become a key player in the NEOINSURANCE® playground

- As an insurer I want to select best-fit strategic Ecosystem Partners for my NEOINSURANCE® ambitions

- As an insurer I want to leverage Open IT Platform solutions that best-support my NEOINSURANCE® capabilities

Deliverables:

- Synpulse NEOINSURANCE-in-a-Box® Model (NIAB®)

- Synpulse NEOINSURANCE Target Operating Model (TOM)®

- Multi-layered Synpulse NEOINSURANCE Capability Model®

- Synpulse Open Platform Assessment Framework®

- Synpulse Embedded Insurance Product & Pricing Model®

- Synpulse Strategic Ecosystem Partner Selection Framework®

- Synpulse NEOINSURANCE Process Map Reference®

Our approach

-

1. Develop an enterprise-wide NEOINSURANCE® vision and strategy

-

2. Define an enterprise-wide NEOINSURANCE® Target Operating Model (TOM)

-

3. Define my target NEOINSURANCE® ambition and accordant target NEOINSURANCE® role

-

4. Develop an initial view of the target capabilities and target maturity levels of the future NEOINSURANCE® readiness

-

5. Review and iterative refinement of the target state in interdisciplinary workshops with defined key stakeholders from all enterprise departments

-

6. Define target-state NEOINSURANCE® delivery model per market and LoB

-

7. NEOINSURANCE® maturity assessment to identify and prioritise gaps (current versus target state)

-

8. Derive an incremental transformation roadmap to pivot towards target state NEOINSURANCE® delivery model (pilot or comprehensive roll-out)

-

9. Define, plan, ramp-up and run NEOINSURANCE® transformation initiatives