Based on our experience with real-life digital transformation programmes, we’re sharing three key takeaways when setting up an engagement banking platform for banks.

With client needs changing and the pressure to manage the costs increasing, banks are forced to undergo a digital transformation that goes beyond a platform or technology change. They need to take control of the customer experience, whilst drastically simplifying and modernising their operations and delivery capabilities.

To support banks in their digital transformation journey, we’re sharing three key takeaways on how to successfully set up an engagement banking platform (EBP).

Takeaway 1: Plan for more than software delivery

The first of our three key takeaways on how to set up an EBP lies in planning for more than just software delivery.

Delivering a new digital banking and client engagement platform isn’t only about the technical delivery of software. It also involves a transformation of the client proposition.

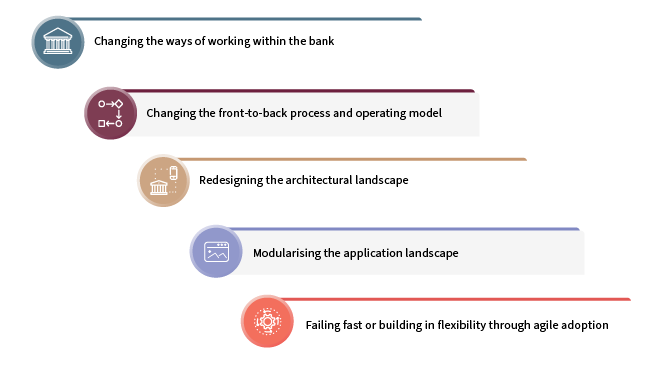

Other changes beyond software delivery that are part of our programmes include:

Our key takeaway

When you’re introducing a new digital banking platform with a deep impact on both the front and the back of the bank, you need to extend the classic software delivery plan.

Backbase and Synpulse support the intake, inception, foundation, training, and delivery project phases to meet the specific needs of the bank’s delivery requirements.

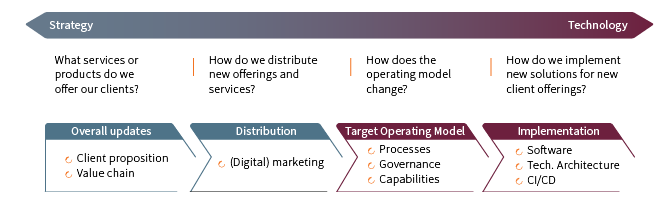

Figure 1 shows the guiding questions and high-level areas when setting up an EBP.

Check out our previous article to learn more about engagement banking: What is an Engagement Banking Platform? | Synpulse

Takeaway 2: Clearly structure teams and interactions for efficiency and visibility

As the second of our three takeaways, we have observed that banks need to clearly structure their teams and interactions for optimised efficiency and visibility.

Our digital transformation programmes on the Backbase EBP use a new methodology to apply the bank’s strategy to leverage its mission or “purpose for existence” and to create a sense of urgency within the programme.

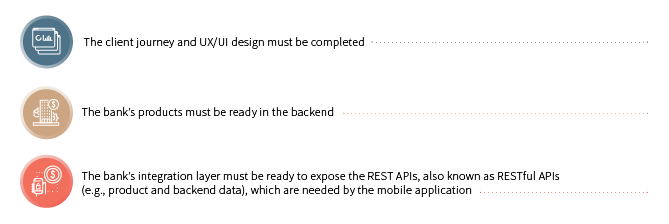

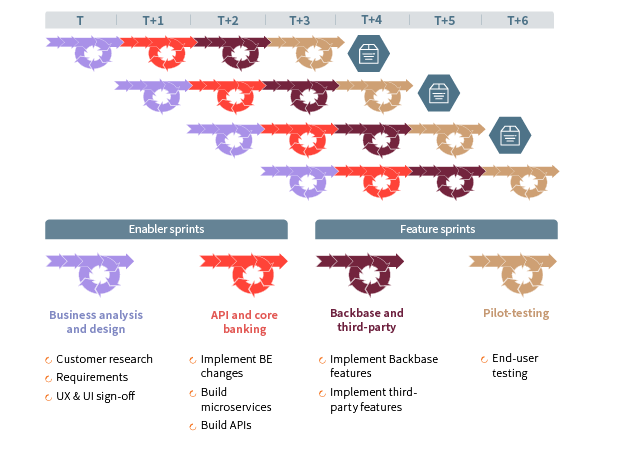

Here are the preconditions needed so that your Backbase delivery squads can release new mobile banking functionality with sprint T+2 (each sprint lasting two weeks):

Takeaway 3: It’s never too early to build up your own skills

As our final takeaway, it's crucial to remember that it's never too early to build up the skills of your employees.

One of the challenges a bank faces is attracting or retaining talent. As banks are competing with technology firms and fintechs, being and remaining an attractive employer is key.

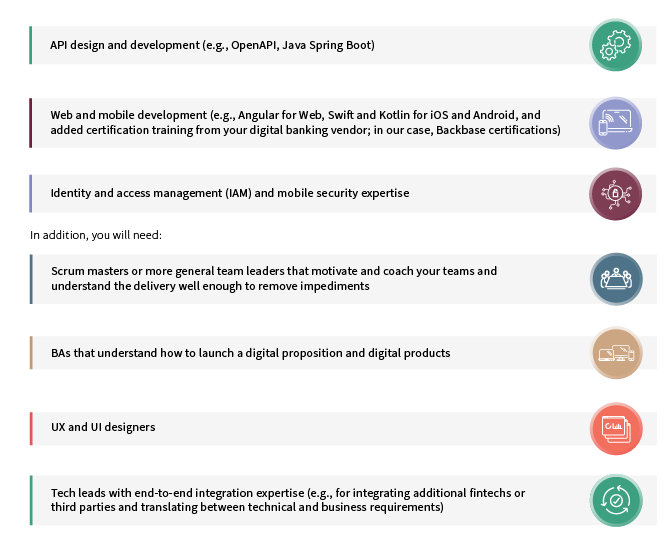

The first step is to empower employees to gain new technology skills and source specific expertise for your digital transformation. The skills needed on the technical side are focused on open and mobile technologies, and specifically include:

Resourcing for a digital transformation programme needs to be planned well ahead. For Backbase engagement banking programmes, we recommend upskilling a part of the existing digital banking team at the beginning of the programme and integrating these new teams with the existing expert teams at Backbase and external suppliers like Synpulse. The earlier you invest in these skills, the higher the return on your investment will be and the quicker you will be able to launch your new platform.

If you’re interested in finding out more and learning how this approach can benefit the digital transformation of your bank, feel free to contact us.