In this article, we identify the key features that can enable digital and rapid customer onboarding to make your client onboarding process invisible.

The prevailing impression of onboarding with banks is one that is both daunting and overwhelming, especially with the need to provide a long list of supporting documents and information in a seemingly never-ending process. Many potential clients dread initiating the onboarding application, and for the “courageous” ones that do, some eventually abandon the process midway due to the long turnaround time and associated overheads.

Feature #1: Digital and social customer experience (CX)

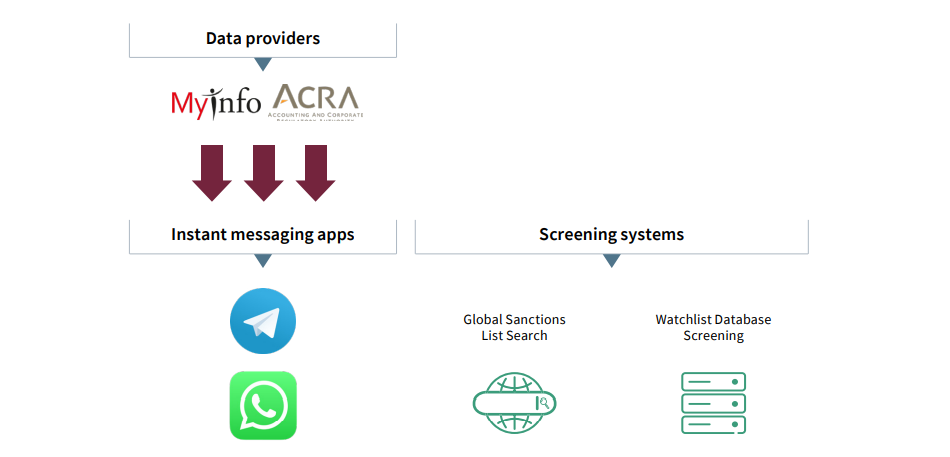

Increasingly, brands are jumping on the bandwagon of using social media, such as Facebook and even instant messaging channels – for instance, WhatsApp and Telegram – to establish and develop personal relationships with their target segment. The same applies to banks, and the benefits of offering a digital and social CX are immense.

By engaging customers through social instant messaging apps, banks amplify the scale of their customer outreach and augment their CX through richer interactions in a user-friendly medium that customers are comfortable and familiar with. Through this conversational banking strategy, banks are able to penetrate and easily integrate into their customers’ daily lives. It also breaks down the idea that onboarding is a tedious process.

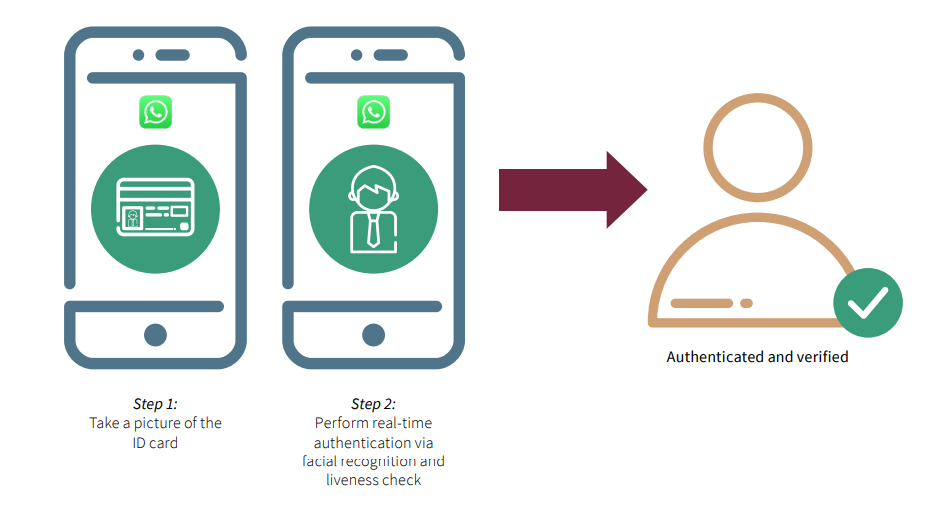

Feature #2: E-verification

One of the bottlenecks within the customer onboarding process lies in the identity and documents verification step.

At this stage, most banks will meet the applicant in person or perform a site visit to the office (for corporate clients) to authenticate the customer’s identity and supplementary documentation. However, travel restrictions caused by the COVID-19 pandemic and rising competition have accelerated the quest for digital verification implementation through leading technologies. To remain competitive, banks need to adhere to the new standard of adopting technology with verification features, such as biometric authentication, facial recognition, liveness detection, and optical character recognition (OCR) capabilities.

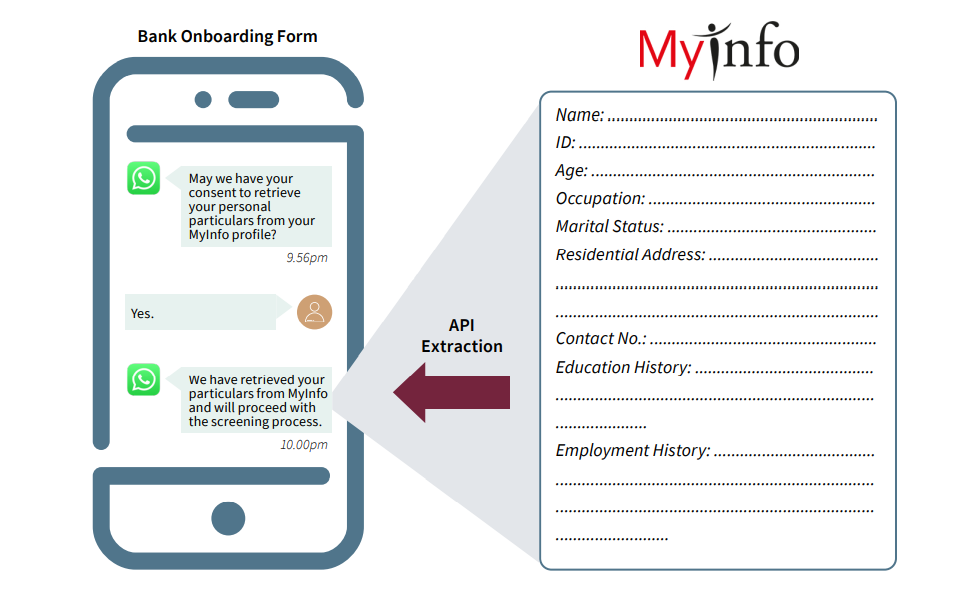

Feature #3: APIs with accredited data sources

In the past, customer onboarding used to be a paper-based process, which required customers to furnish significant documentation for verification purposes and relied heavily on the bank’s staff to perform data entry and corroboration.

Today, banks can directly source the requisite information from the governments’ centralised repository of individuals’ personal particulars using secure APIs. For instance, in Singapore, banks can obtain KYC-related information from MyInfo for individuals, or MyBusiness or ACRA for corporate customers, upon receiving authorisation. By automating data collection and verification activities, time and effort can be saved for banks and customers whilst reducing data duplication and inaccuracies.

Feature #4: Digitised rulebook

Depending on the customer type and product usage, along with a myriad of parameters, the due diligence that needs to be fulfilled for each customer varies. Thus, a key challenge that many bank staff face in the onboarding process is the need to derive a consolidated list of de-duped requirements.

To address this pain point, implementing a digitised rulebook, which tailors the list of due diligence requirements for each customer based on their risk profile and local jurisdiction specifications, is crucial. By having a digitised rulebook, the customer experience can be optimised by eliminating unnecessary back-and-forth communication, and compliance risk can be reduced by lowering the probability of missing due diligence requirements in the process.

Feature #5: Intelligent KYC capabilities

One of the biggest pain points for banks during customer onboarding is the manual process of completing enhanced due diligence on the customer, including the source of wealth corroboration, identification of the Ultimate Beneficial Owner (UBO), and screening. Especially in the case of corporates, bank staff often find themselves searching through vast corpuses of information – company websites, corporate registries, search engines, electronic databases, etc. – to source the requisite information.

However, this need not be the case any longer. Through the usage of intelligent tools, such as robotics process automation (RPA), advanced algorithms, and national language processing capabilities, processing time can be significantly reduced. For banks to stay competitive, they need to enable smart working.

Feature #6: Integration with back-end systems

With the use of technology that is available today, onboarding processes can now be significantly streamlined, especially by carrying out multiple time-consuming activities simultaneously.

One example is to initiate the background adverse media, politically exposed person (PEP), or sanctions screening once requisite customer identification and verification documentation are received. This can be done while customer outreach continues for other aspects, such as product advisory or tax documentation.

With parallel processing, staff productivity improves as unnecessary waiting time and bottlenecks are eliminated. Customer satisfaction also increases, as the overall process is expedited, and the customers are kept abreast with their application progress.

Feature #7: Digital signatures

To provide evidence that the customers have consented to, and authorised, their onboarding applications, banks would need to obtain their customers’ signatures. However, the way banks conduct this step today often translates to countless manual paperwork and physical meetings.

One key feature of an optimal onboarding solution is that customers are enabled to digitally provide their signatures in a way that is also compliant with local and industry standards. Banks that enable their customers to provide a digital signoff enjoy the benefit of having more satisfied customers and lower costs that are associated with quicker turnaround time.

Feature #8: Built-in digital assistant

Segregation of duties between digital assistants and human relationship managers (RMs) sensibly leverages each of their strengths. This maximises operational efficiency and reduces overall customer lifecycle management costs.

A hybrid conversational banking solution, such as Synpulse’s involves both an AI-powered digital assistant and human RMs, with each having its own set of responsibilities. With their round-the-clock availability and natural language processing (NLP) capabilities, digital assistants are designated to address common customer requests and initiate guided onboarding workflows with contextualised prompts, leaving the more unique and complex issues for human RMs to tackle.

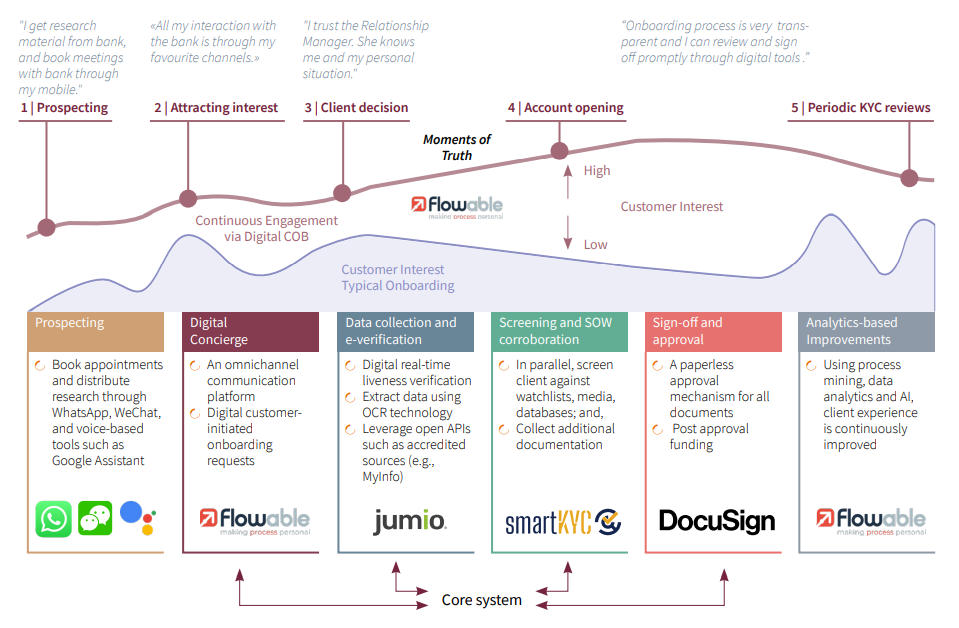

Synpulse’s solution to a seamless client onboarding

Through our extensive market experience, research, and innovation, Synpulse has developed a seamless end-to-end onboarding solution that is tailored to both individuals and SMEs. Our hypothesis is that an onboarding application can be completed in as quickly as 10 minutes for individuals, and within an hour for SMEs, anytime and anywhere.

With our in-depth knowledge of the industry’s pain points and trends, coupled with a rich ecosystem of partners, we have developed a seamless customer onboarding solution, which weaves the best-of-breed solutions that incorporate the features to provide a superior experience.

Customer onboarding is a bank’s first engagement with its customers, and it plays a big role in determining whether a customer decides to continue or abandon the banking relationship.

Speak to our experts to find out how you can transform your onboarding offering into an industry-leading practice or view a demo of our onboarding solution.