Explore the diverse capabilities and strategies that wealth managers in China are adopting to cater to the dynamic needs of their clients.

As the landscape of financial services continues to evolve, digital advisory services have emerged as a transformative force within the Chinese market. China’s digital advisory market has witnessed significant growth, reflecting the increasing demand for innovative wealth management solutions.

In our previous article, we delved into the market trends shaping the advisory landscape in China, accompanied by insights into the solutions that banks should look out for. Building on that foundation, this article delves into the diverse approaches that wealth managers can adopt to harness the full potential of digital advisory services.

Assessing digital advisory capabilities

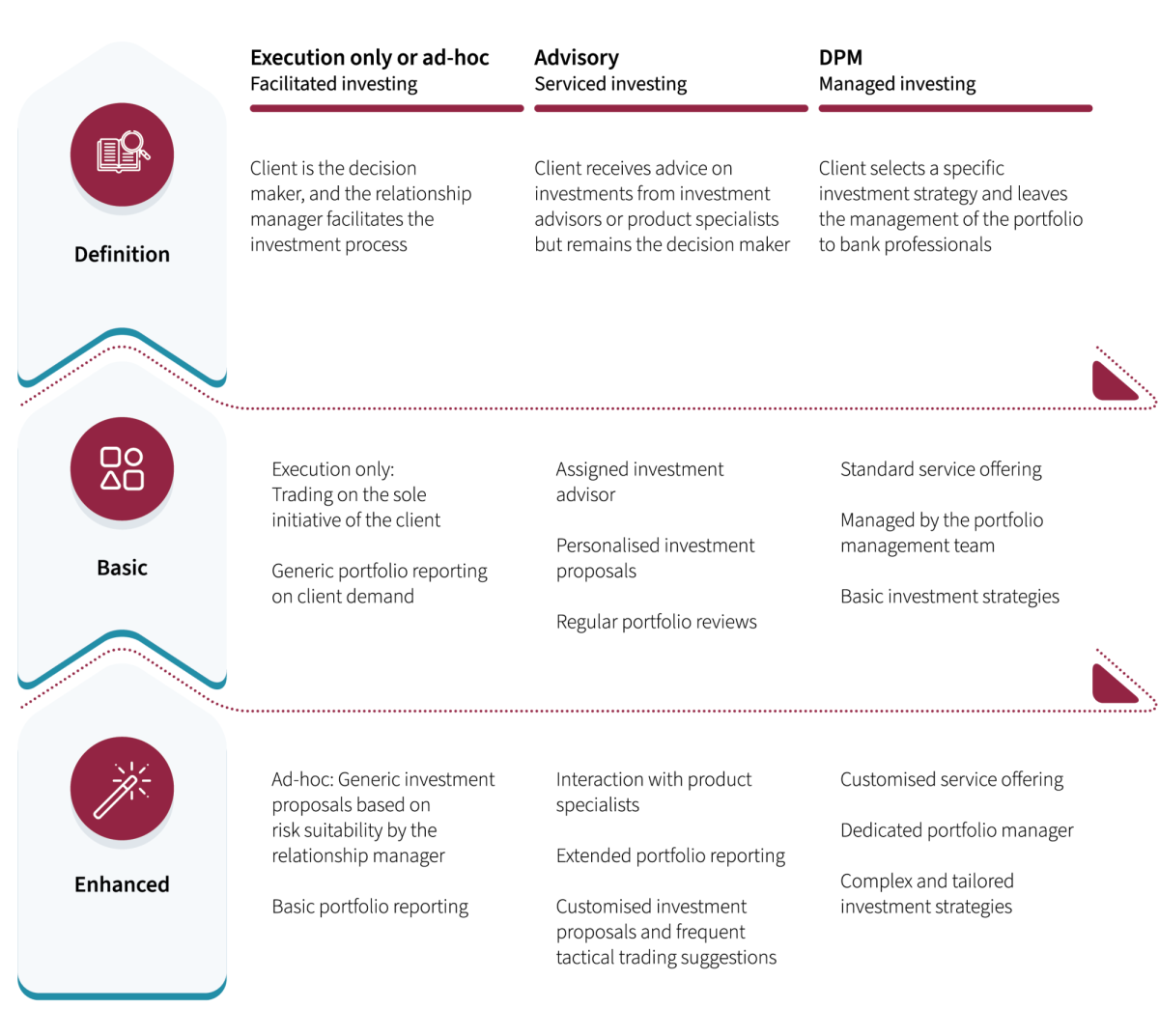

Digital advisory services encompass a spectrum of approaches, ranging from execution-only or ad-hoc models to more personalised advisory and discretionary portfolio management (DPM) services. These models offer clients varying levels of control and guidance over their investments, making them a central focus for wealth managers.

An assessment of wealth managers’ digital advisory capabilities is crucial for understanding how financial institutions are adapting to the digital age and leveraging technology to provide investment advice and services. These investment services can be categorised into three models:

- Execution-only or ad-hoc

- Advisory

- Discretionary portfolio management

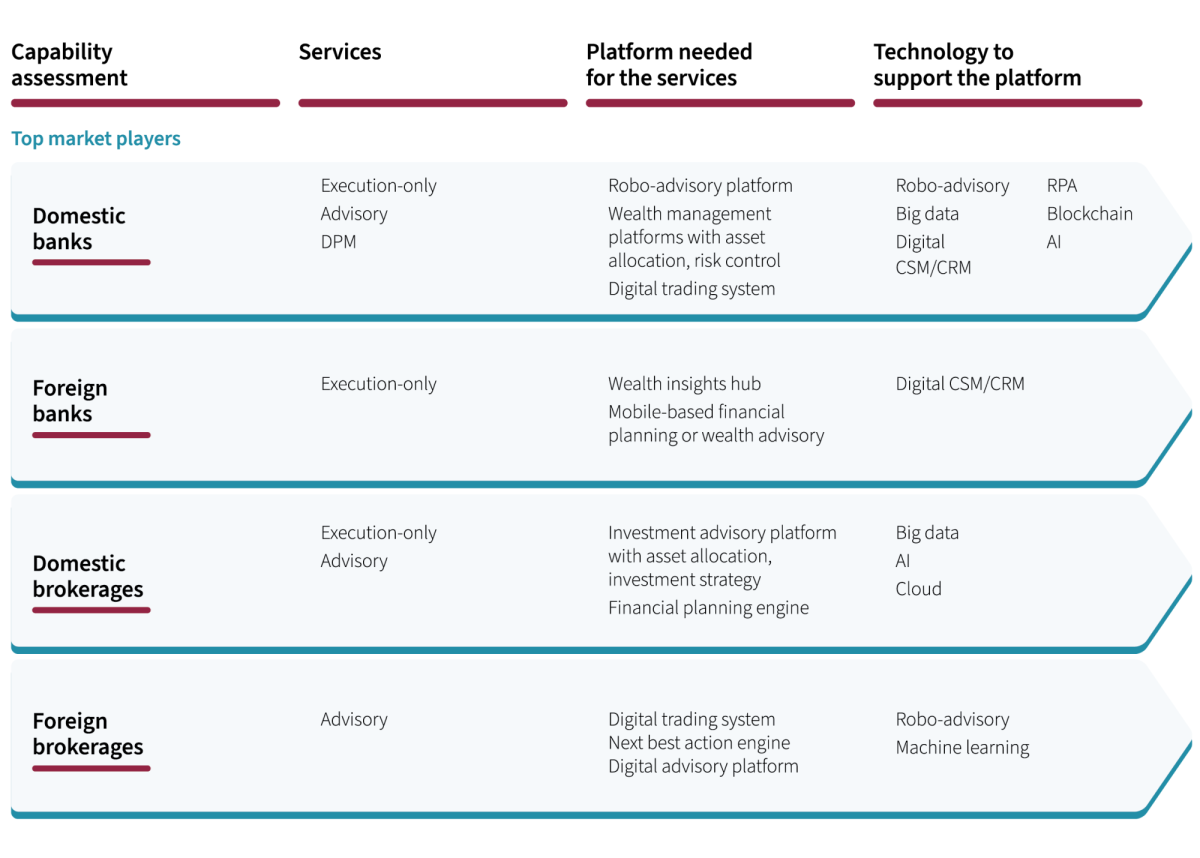

Using these models as a benchmark, we compared the leading players in China’s banking and brokerage segments, focusing on their digital capabilities. This includes the various digital platforms and the technologies applied across the end-to-end advisory process.

A comparison of the top market players

Top banking players in China

The advisory sphere is highly dominated by domestic banks in Mainland China, with mature capabilities in digital advisory or robo-advisory. They are observed to have developed in-house solutions for digital onboarding or customer relationship management (CRM), digital advisory, and big data-related analytics.

In comparison, foreign banks currently provide execution-only advisory or wealth management services but are expected to strengthen their local advisory teams in China over the next couple of years.

Top brokerage players in China

Leading brokerage players initially provide digital advisory platforms for retail clients and high-net-worth individuals (HNWIs). Compared with banks, they explore the digital transformation for wealth management more holistically and with more dimensions. Top players developed in-house platforms, while medium- to small-size players choose to cooperate with third-party trading systems.

In contrast to domestic players, foreign brokerage firms are still in the initial stage of business development, with limited branches, licences, and assets. However, many top foreign players are in the process of applying for brokerage licences, including advisory licences.

Market’s best practices

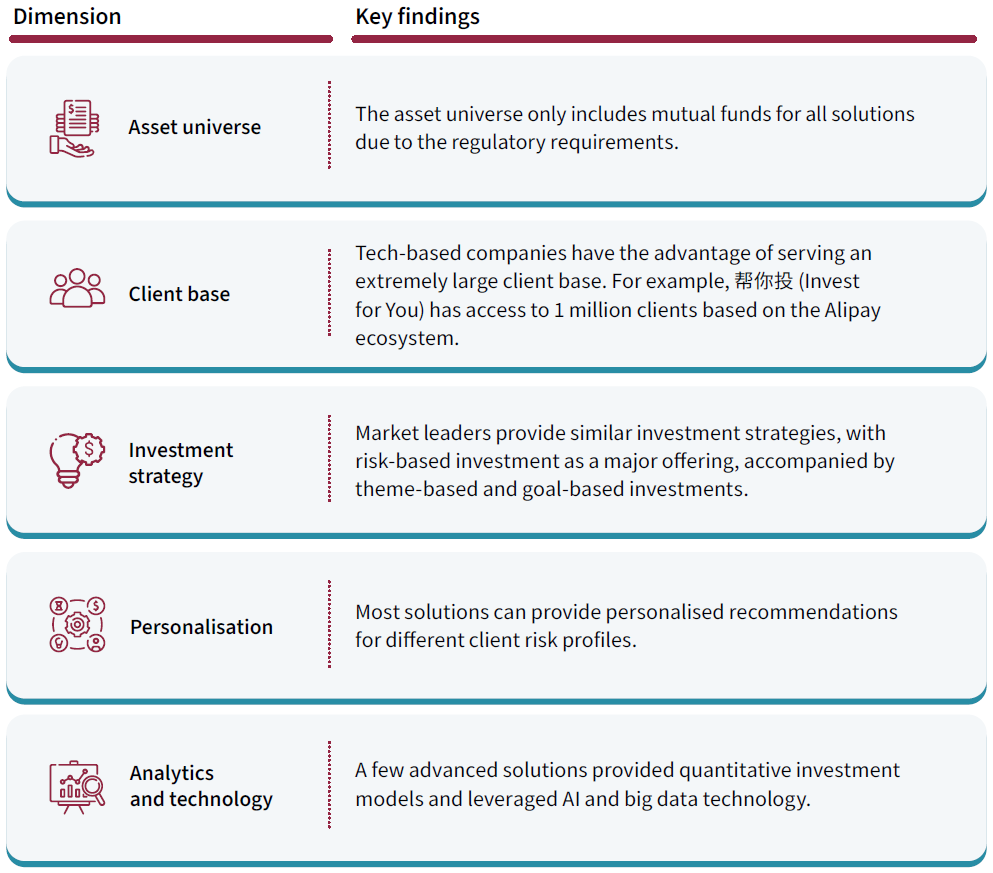

Since the pilot launch of comprehensive advisory services in 2019 (refer to our article on regulatory developments in China’s digital advisory to learn more, 60 qualified institutions have begun offering digital advisory solutions for mutual funds in Mainland China.

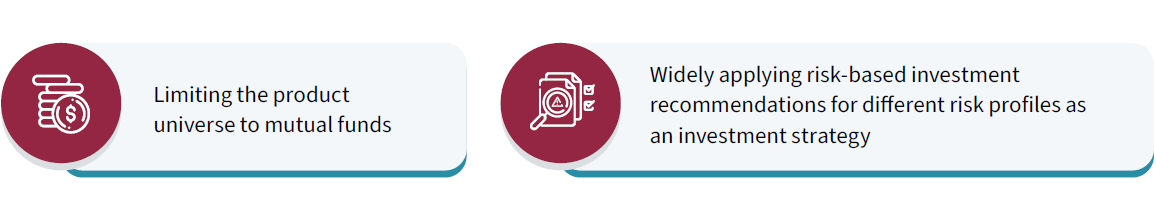

Based on research and surveys conducted with major institutions in the industry, we have identified two common capabilities shared by market leaders in their digital advisory services and solutions:

Furthermore, different types of institutions distinguish themselves through their expertise in digital advisory services:

Ultimately, delivering a top-notch advisory service requires the financial institution’s ability to identify a suitable value proposition in the market and develop a profitable service model. Additionally, to build a robust advisory solution, institutions must address concerns on operating models, user journeys, data management, investment strategies, and more. This will eventually lead to the establishment of a seamlessly integrated and intelligent advisory platform.

However, when developing a digital advisory roadmap, a crucial initial consideration is whether to build an in-house solution or acquire software from a third-party vendor. Generally, there is no simple answer as to whether to build or buy. This decision largely depends on the unique circumstances of the bank, which requires a careful evaluation of the organisation's priorities, resources, and expectations.

Building in-house: The benefits of customisation and a long-term commitment

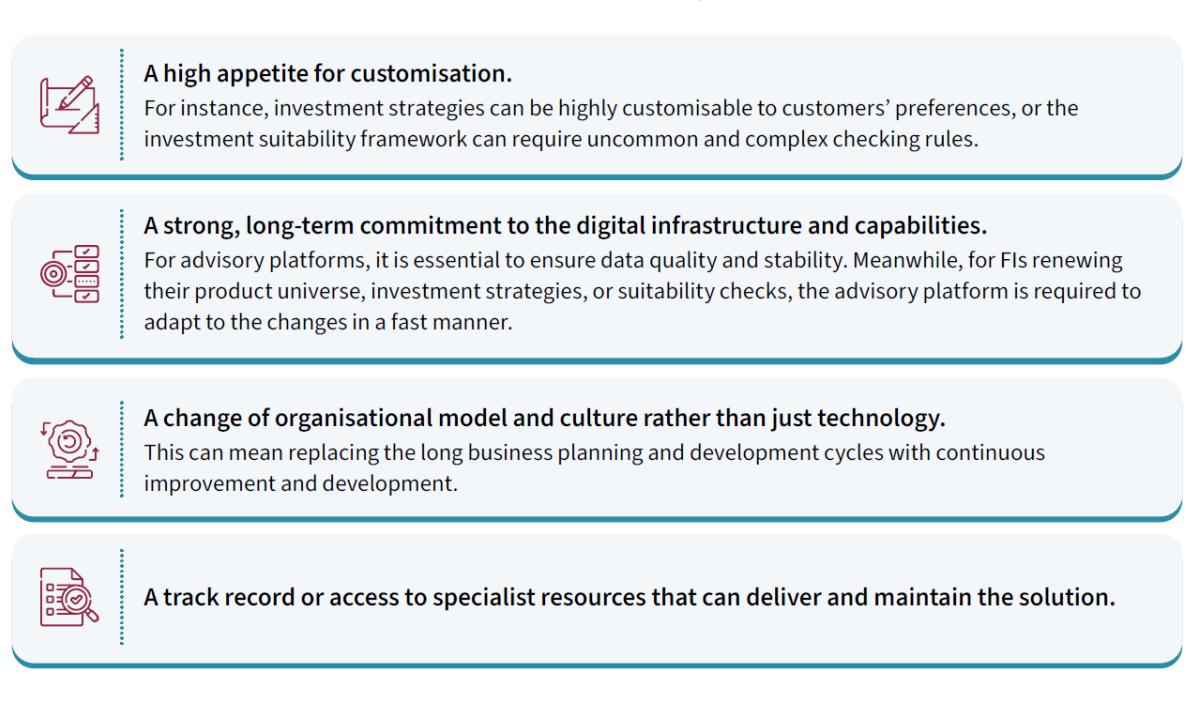

The business case for building your digital advisory solutions in-house requires several key ingredients:

Buying from a third party: An effective entry strategy

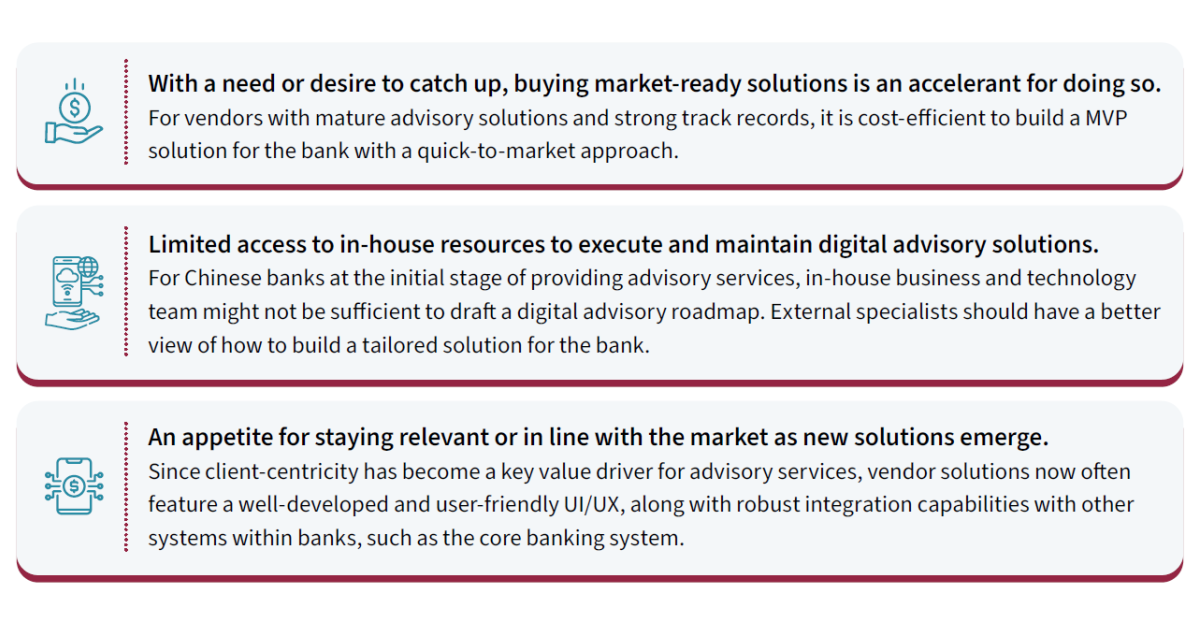

Banks buying digital solutions from a third party often have a set of common characteristics:

Regardless of the decision to build or buy, financial institutions should start by conducting a thorough assessment of their backend digitisation maturity. After all, the cost of pairing a fancy frontend with an outdated backend is high, and it can delay the implementation of customer-facing services and potentially increase operational and reputational risks.

Moreover, this step is crucial when estimating the total cost of launching customer-facing digital functionalities, as institutions of varying sizes and natures may be better suited for different backend and frontend models. We advise financial institutions to assess the optimal strategy, whether building or buying, along with the associated costs.

How we can support you

At Synpulse, we collaborate with leading financial institutions to deliver valuable advisory services and platform implementations to our clients. Backed by our technological powerhouse, Synpulse8, we offer holistic solutions that bridge any gaps, ensuring we meet your business needs.

Check out our modular architecture to future-proof your wealth management capabilities: Our Solutions - PULSE8 - Wealth Cockpit — Synpulse8

Our extensive expertise in wealth management, digital advisory, and regulatory compliance is at your disposal. Reach out to us to learn more!