Loading Insight...

Insights

Insights

In this article, we explore our NEOINSURANCE® core belief, focusing on how insurers must adopt digital operating models to meet evolving customer demands and navigate changing market dynamics.

New entrants in industries like automotive, e-commerce, and insurtech are disrupting the insurance industry with faster, more innovative products. This compels traditional insurers to adapt and innovate to maintain market competitiveness.

Navigating the digital transformation era

Insurers in the digital transformation era have the choice to either incrementally enhance their digital capabilities or adopt multiple operating models concurrently, depending on their business proposition, target customer segments, and markets.

Instead of a complete transformation, insurers can pursue a twin approach, utilising minimal shared services, capabilities, and applications as a common foundation across all models. This strategy allows insurers to optimise their digital transformation while maintaining agility and customisation.

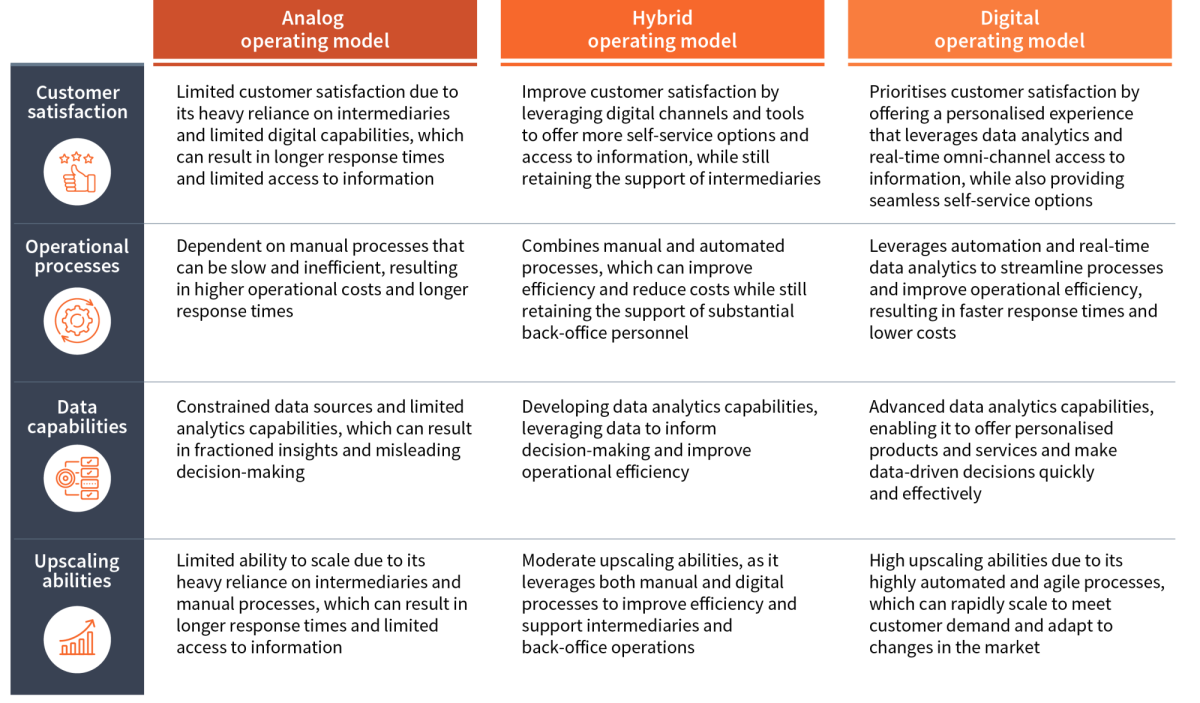

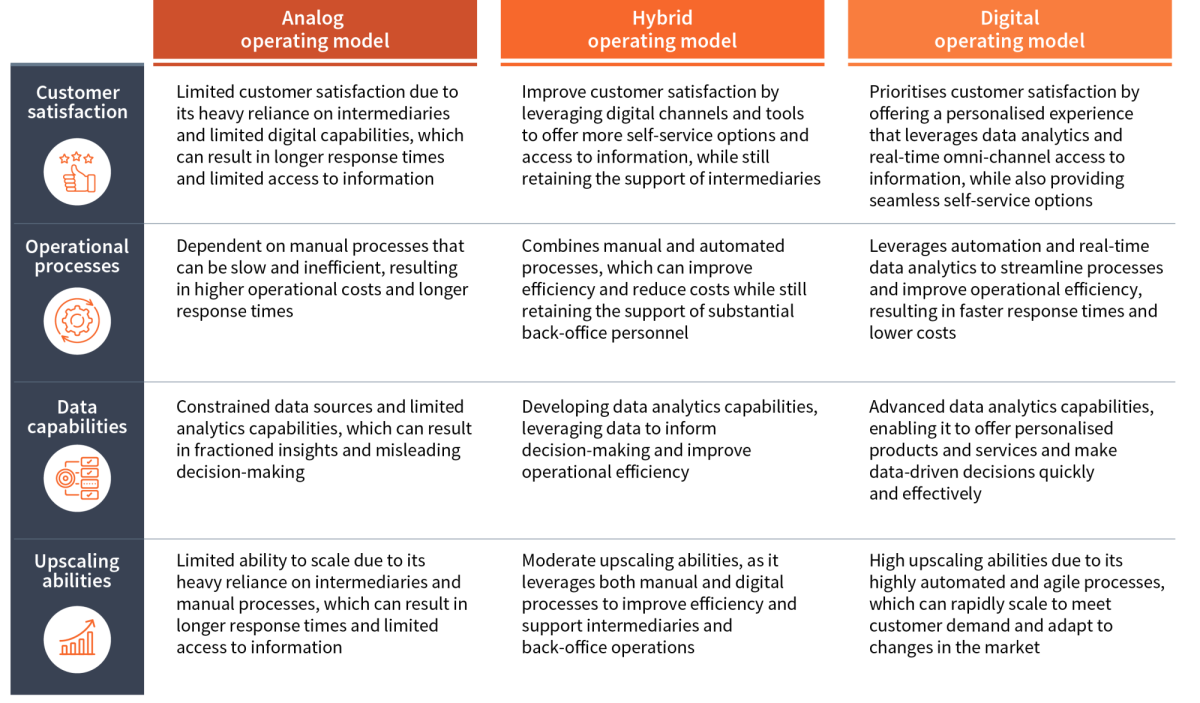

Figure 1: The evolution of digital operating models

- Analogue operating model: While predominantly relying on manual processes and utilising technology only to a limited extent, this approach may still have a valid place within certain segments of the insurance industry. It is particularly relevant in regions with limited technology infrastructure or when serving a more traditional clientele with little digital affinity.

- Hybrid operating model: This approach combines analogue and digital processes, making it appropriate for insurers underlying system and process modernisation, as well as those serving customers with varying preferences for digital and analogue solutions.

- Digital operating model: This approach fully harnesses the power of the latest generation of open insurance technology platforms and advanced data management capabilities. It is particularly well-suited for insurers aiming to differentiate themselves through innovative business models, such as embedded insurance or even exploring insurance in the metaverse. This paves the path to new markets and revenue potential.

Through our NEOINSURANCE® brand, we have developed a proprietary digital operating model with a comprehensive suite of assets to help insurers shift from analogue to digital operating models. Our model is designed to optimise efficiency and synchronisation, resulting in a streamlined organisation primed for success in today's digital marketplace.

Our NEOINSURANCE® digital operating model seamlessly integrates digital technology and data analytics to optimise processes, boost efficiency, and enhance customer convenience and experience. It includes a range of digital platforms, tools, and processes designed to streamline operations, offer personalised products and services, and improve risk assessment capabilities.

How we can help

We can help you achieve your digital transformation goals with our proven assets and deep insurance expertise in all lines of business. We look forward to engaging in a detailed discussion about your needs and how our offerings can effectively support and accelerate your transformation.

Contact us now to take the next step in your digital transformation journey!

In this article, we explore our NEOINSURANCE® core belief, focusing on how insurers must adopt digital operating models to meet evolving customer demands and navigate changing market dynamics.

New entrants in industries like automotive, e-commerce, and insurtech are disrupting the insurance industry with faster, more innovative products. This compels traditional insurers to adapt and innovate to maintain market competitiveness.

Navigating the digital transformation era

Insurers in the digital transformation era have the choice to either incrementally enhance their digital capabilities or adopt multiple operating models concurrently, depending on their business proposition, target customer segments, and markets.

Instead of a complete transformation, insurers can pursue a twin approach, utilising minimal shared services, capabilities, and applications as a common foundation across all models. This strategy allows insurers to optimise their digital transformation while maintaining agility and customisation.

Figure 1: The evolution of digital operating models

- Analogue operating model: While predominantly relying on manual processes and utilising technology only to a limited extent, this approach may still have a valid place within certain segments of the insurance industry. It is particularly relevant in regions with limited technology infrastructure or when serving a more traditional clientele with little digital affinity.

- Hybrid operating model: This approach combines analogue and digital processes, making it appropriate for insurers underlying system and process modernisation, as well as those serving customers with varying preferences for digital and analogue solutions.

- Digital operating model: This approach fully harnesses the power of the latest generation of open insurance technology platforms and advanced data management capabilities. It is particularly well-suited for insurers aiming to differentiate themselves through innovative business models, such as embedded insurance or even exploring insurance in the metaverse. This paves the path to new markets and revenue potential.

Through our NEOINSURANCE® brand, we have developed a proprietary digital operating model with a comprehensive suite of assets to help insurers shift from analogue to digital operating models. Our model is designed to optimise efficiency and synchronisation, resulting in a streamlined organisation primed for success in today's digital marketplace.

Our NEOINSURANCE® digital operating model seamlessly integrates digital technology and data analytics to optimise processes, boost efficiency, and enhance customer convenience and experience. It includes a range of digital platforms, tools, and processes designed to streamline operations, offer personalised products and services, and improve risk assessment capabilities.

How we can help

We can help you achieve your digital transformation goals with our proven assets and deep insurance expertise in all lines of business. We look forward to engaging in a detailed discussion about your needs and how our offerings can effectively support and accelerate your transformation.

Contact us now to take the next step in your digital transformation journey!