Loading Insight...

Insights

Insights

Discover how ChatGPT, a powerful AI chatbot, can revolutionise the insurance industry by enhancing operations, improving customer experiences, and reducing costs. This article showcases real-world examples of insurance companies using ChatGPT and offers insights into successful implementation.

Technological innovation is crucial for the overall success of insurers nowadays, as new technologies become more sophisticated and widely adopted by insurtechs and new players in the increasingly digitalised economy. Artificial intelligence (AI) and machine learning (ML) tools have the potential to revolutionise how insurers perceive, forecast and operate their business and unleash unprecedented growth potentials. The ecosystem imperative (as we have outlined in our NEOINSURANCE® whitepaper) has urged insurers to shift from a product-centric to a lifestyle-oriented approach. A NEOINSURER® uses emerging technological developments to draw the right actionable decisions to build even more efficient, embedded, and cost-effective use cases based on new open architecture frameworks with an unprecedented level of digital experience, performance, and flexibility.

In recent years, the insurance industry has witnessed significant technological advancements, particularly in the realm of natural language processing (NLP) powered by generative pre-trained transformer (GPT) technology. While it is important to note that AI applications for insurance have a history predating ChatGPT, this latest technological evolution has marked a substantial leap forward. One of the things on everyone's mind in recent days is ChatGPT, among the array of AI offerings from various institutions and technology providers, which has garnered notable attention due to its advanced capabilities and prominence in the current landscape. Its emergence has underscored the transformative potential of AI-driven solutions in the insurance sector.

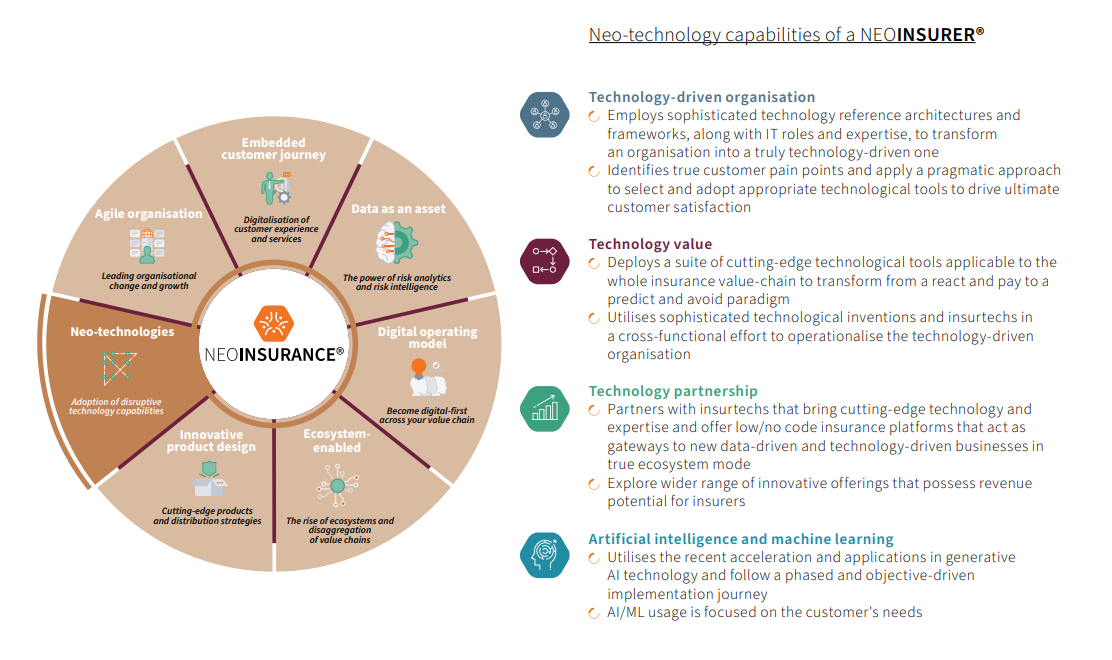

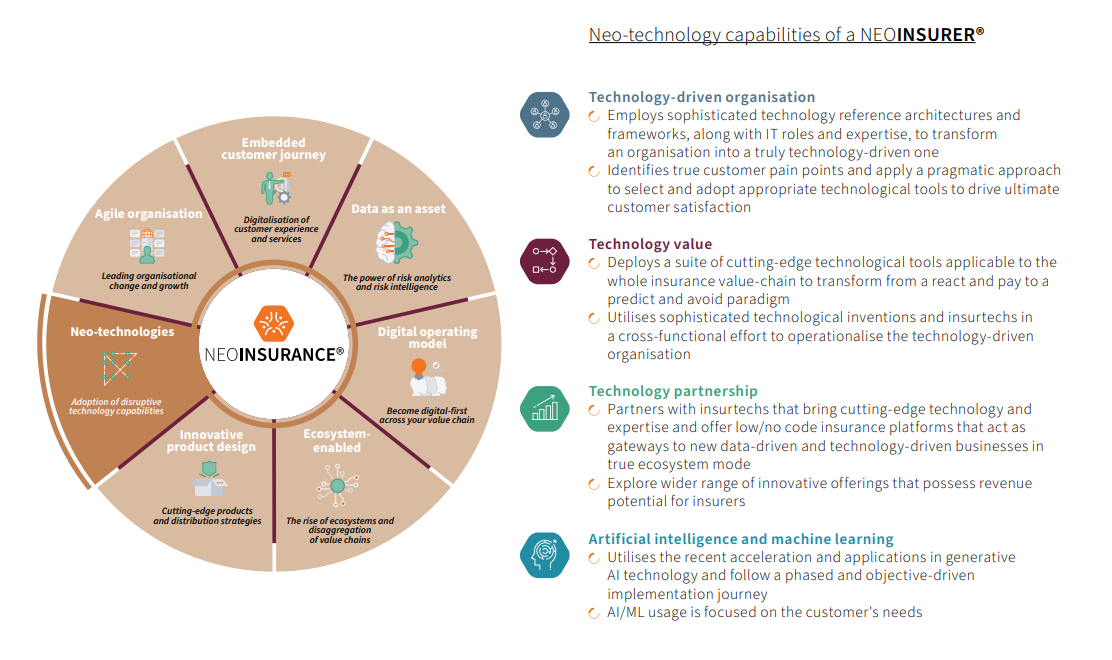

Synpulse believes that ChatGPT can transform the current business models across the insurance lifecycle for higher efficiency, better cost-effectiveness, and improved customer experience, bringing in enormous monetisable value. This article is part of the neo-technologies core belief, one of the key components within our NEOINSURANCEINABOX® offerings portfolio (See Figure 1). We will be introducing more components in the coming months, so do stay tuned.

Figure 1: NEOINSURANCEINABOX®

What's covered in the full article:

Discover the game-changing potential of ChatGPT for insurance companies and how it can enhance operations, reduce costs, and improve customer experiences. In the complete article, you'll explore:

- How ChatGPT can benefit insurers in various critical areas.

- A comprehensive guide on how to successfully incorporate ChatGPT into your insurance business.

Ready to unlock the future of insurance with ChatGPT? Download the full article now for in-depth insights and actionable strategies.

If you would like to know more and unblock the ChatGPT journey for your organisation, please don’t hesitate to reach out to us.

We will be releasing further components of the NEOINSURANCE® model in the coming months, so do stay tuned.

Discover how ChatGPT, a powerful AI chatbot, can revolutionise the insurance industry by enhancing operations, improving customer experiences, and reducing costs. This article showcases real-world examples of insurance companies using ChatGPT and offers insights into successful implementation.

Technological innovation is crucial for the overall success of insurers nowadays, as new technologies become more sophisticated and widely adopted by insurtechs and new players in the increasingly digitalised economy. Artificial intelligence (AI) and machine learning (ML) tools have the potential to revolutionise how insurers perceive, forecast and operate their business and unleash unprecedented growth potentials. The ecosystem imperative (as we have outlined in our NEOINSURANCE® whitepaper) has urged insurers to shift from a product-centric to a lifestyle-oriented approach. A NEOINSURER® uses emerging technological developments to draw the right actionable decisions to build even more efficient, embedded, and cost-effective use cases based on new open architecture frameworks with an unprecedented level of digital experience, performance, and flexibility.

In recent years, the insurance industry has witnessed significant technological advancements, particularly in the realm of natural language processing (NLP) powered by generative pre-trained transformer (GPT) technology. While it is important to note that AI applications for insurance have a history predating ChatGPT, this latest technological evolution has marked a substantial leap forward. One of the things on everyone's mind in recent days is ChatGPT, among the array of AI offerings from various institutions and technology providers, which has garnered notable attention due to its advanced capabilities and prominence in the current landscape. Its emergence has underscored the transformative potential of AI-driven solutions in the insurance sector.

Synpulse believes that ChatGPT can transform the current business models across the insurance lifecycle for higher efficiency, better cost-effectiveness, and improved customer experience, bringing in enormous monetisable value. This article is part of the neo-technologies core belief, one of the key components within our NEOINSURANCEINABOX® offerings portfolio (See Figure 1). We will be introducing more components in the coming months, so do stay tuned.

Figure 1: NEOINSURANCEINABOX®

What's covered in the full article:

Discover the game-changing potential of ChatGPT for insurance companies and how it can enhance operations, reduce costs, and improve customer experiences. In the complete article, you'll explore:

- How ChatGPT can benefit insurers in various critical areas.

- A comprehensive guide on how to successfully incorporate ChatGPT into your insurance business.

Ready to unlock the future of insurance with ChatGPT? Download the full article now for in-depth insights and actionable strategies.

If you would like to know more and unblock the ChatGPT journey for your organisation, please don’t hesitate to reach out to us.

We will be releasing further components of the NEOINSURANCE® model in the coming months, so do stay tuned.