After more than 18 months since the pilot scheme’s announcement, regulators formally debuted Wealth Management Connect's (WMC) cross-border pilot program in the Greater Bay Area (GBA) in September 2021. The Hong Kong Monetary Authority (HKMA) has released detailed arrangements to further facilitate the implementation of the WMC operating model and the framework. The implementation arrangements set out in the Circular1 apply to Hong Kong banks that participate in Northbound and Southbound business activities under the WMC scheme.

It is expected that regulators, such as The People’s Bank of China (PBOC)2 and the HKMA, will enhance the regulatory requirements for industry participants, in hopes of ensuring a smooth implementation and further development of the WMC Scheme.

Understanding the Southbound and Northbound scheme

To comply with the cross-border requirements of the scheme, the participating banks will have to adapt and/or develop a fit-for-purpose framework that incorporates an end-to-end process in areas such as client onboarding and account opening, cross-boundary remittance and quota management, product due diligence, controls, and supervision.

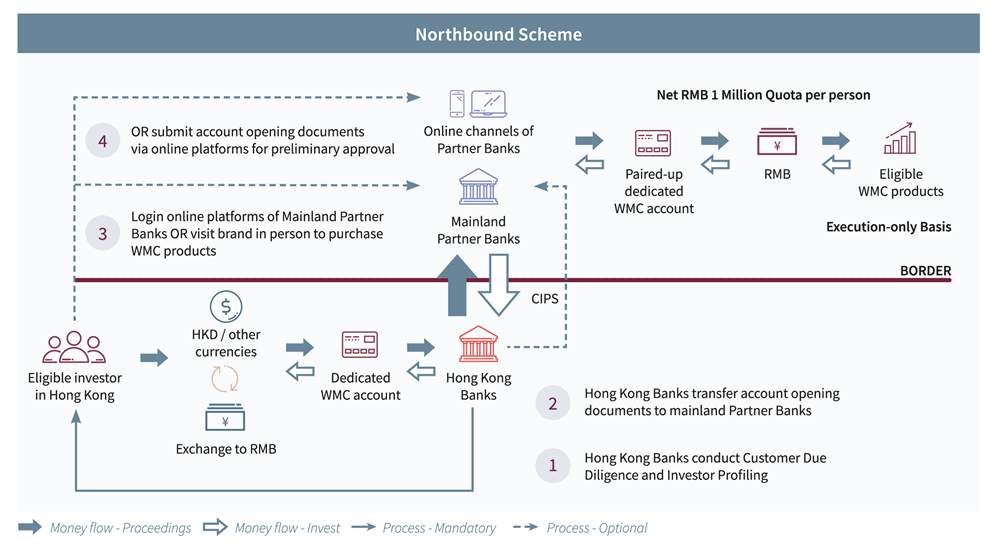

The Northbound Scheme

Under the Northbound Scheme, eligible investors3 in Hong Kong can invest in eligible wealth management products provided by Mainland China banks participating the WMC Northbound Scheme.

Hong Kong banks must take note of:

- Opening of accounts

Hong Kong banks must conduct the initial customer due diligence and investor profiling for prospective clients to open a dedicated WMC account with their Mainland China partner banks.

How to open an account:

Option 1: Hong Kong banks must transfer the prospective client’s account opening documents to their Mainland China partner banks to facilitate the pre-account opening process with the partner banks.

Option 2: Prospective clients can directly submit their account opening documents to Mainland China banks through their online platforms. Once a Mainland China account is opened, it must be paired with one dedicated WMC account with a Hong Kong bank to form a close-end loop.

- Money flow quota

Money flow within the two accounts is subject to the quota of net RMB 1 million per person. Separately, the money flow between Hong Kong banks and their partner banks is subject to the aggregated quota of net RMB 150 billion. Hong Kong banks are expected to keep accurate records of the money entering and leaving the designated remittance accounts. Mainland China banks are required to record the information in RCPMIS3 before the first remittance and conduct the remittance in RMB via CIPS4.

- Currency exchange

Eligible customers can exchange their investment capital from HKD or other currencies to RMB within their Hong Kong accounts.

- Purchasing of products

Eligible customers can also purchase the WMC Scheme’s wealth management products through the Mainland China banks’ online platforms or by visiting the Mainland China banks’ branches in person

- Solicitation or recommendation:

At this stage, no solicitation or recommendation to clients is allowed for the purchase of products. Mainland China partner banks can, upon request, provide explanatory information to the customers through their mobile or online channels but cannot proactively invite customers, or travel across the border to provide investment advisory services.

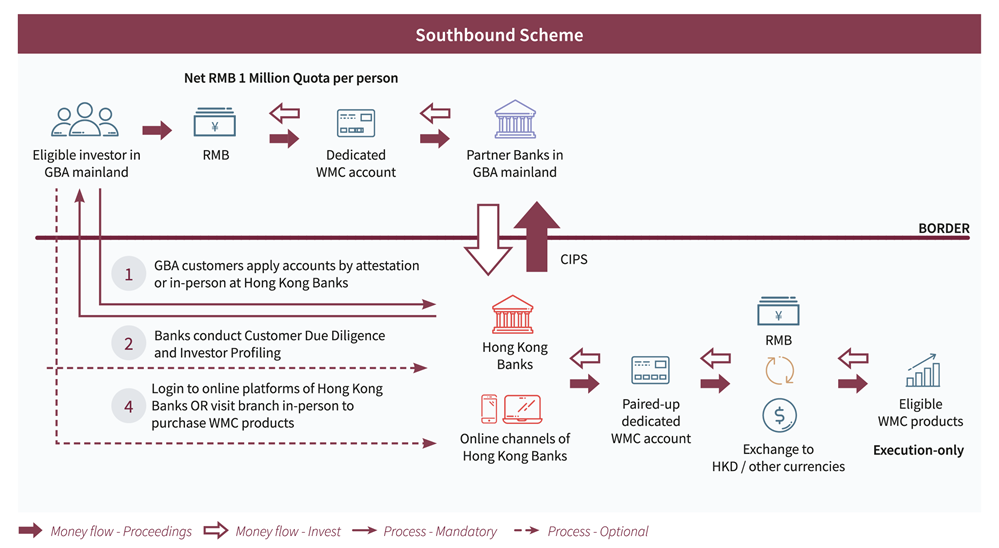

The Southbound Scheme

Under the Southbound scheme, eligible investors6 in the Guangdong Province can invest in eligible wealth management products provided by Hong Kong banks that participate the WMC southbound scheme.

Hong Kong banks must take note of:

- Opening of accounts

Once eligibility is confirmed by the Mainland China banks, prospective clients in Guangdong can apply for an investment account with the Hong Kong banks by attestation (ID&V is done by the Mainland China banks) or by visiting the Hong Kong banks in person.

It’s the responsibility of Hong Kong banks to conduct customer due diligence and investor profiling to ensure proper disclosure of information and risks controls.

Once the Hong Kong account is opened, it must be paired with one dedicated WMC account in the Mainland Chia banks to form a close-end loop.

- Money flow quota

As with the Northbound Scheme, the money flow within the two accounts is subject to the quota of net RMB 1 million per person, whereas the money flow between Hong Kong banks and their partner banks is subject to the aggregated quota of net RMB 150 billion. Similar to the Northbound scheme, Hong Kong banks participating in the Southbound scheme should maintain proper records of the flows of funds in and out of dedicated remittance accounts. Mainland China banks are required to record the information in RCPMIS before the first remittance and conduct the remittance in Renminbi through CIPS.

- Currency exchange

Eligible customers should exchange the investment capital from RMB to HKD or other currencies within their Hong Kong accounts.

- Purchasing of products

Eligible customers can also purchase the WMC wealth management products through the Hong Kong banks’ online platforms by visiting their branches in person.

- Purchasing due diligence

At this stage, it’s the responsibility of the Hong Kong banks to continually conduct he product due diligence on the eligibility of the low-to-medium risk products, such as investment products (authorised funds and bonds) and deposits.

- Solicitation or recommendation:

At this stage, no solicitation or recommendation is allowed to clients for the purchase of products.

Hong Kong banks to seize the opportunities

Competition for the initial market share

Under the Scheme, eligible investors are permitted to open a pair of dedicated investment accounts. However, banks are required to perform extensive due diligence checks prior to opening the account to ascertain that the investors have not already opened the same type of account with other banks. As a result, high switching costs are embedded to prevent investors from frequently switching between banks. To compete for the initial market share, Hong Kong banks are encouraged to take quick actions to prepare and deploy appropriate strategies to acquire customers as soon as the initial market opens.

Clear cross-border policy

Under the execution-only and non-solicitation rules, more constraints are added to the cross-border business. Banks should invest resources to revamp and implement a fit-for-purpose selling process and design a scheme-specific marketing strategy for WMC.

A comprehensive cross-border policy and series of trainings and guidance will be offered to staff at the first and second lines of defence, with robust monitoring of the communication process. It also requires system enhancements in order to capture all the correspondence and communications (such as emails and recording lines) for a clear audit trail. The cross-border policy should cover the end-to-end processes, from investor eligibility checking and client due diligence, to account opening and post-trade activities.

Partnership with Mainland China Banks7

Partnering with Mainland China banks is a crucial requirement to complete the process under the WMC Scheme’s operational model. It also provides additional channels for networking and marketing towards Mainland China clients since this partnership will potentially extend the outreach to the partner banks’ existing client pool. The partnership will allow Hong Kong banks to increase their profitability through higher market exposure and expansion of the business line.

To capitalise on this requirement, banks should develop a holistic partnership strategy, which includes partner identification, clarification of joint priority, a definition of the structure and metrics for reviewing the relationships, and forming a dedicated team to manage the relationship with clearly defined roles, responsibilities and sufficient resources to support.

Robust due diligence framework

A robust investment suitability framework and solid capability of product management, including product due diligence and risk assessment, can directly affect the customer experience. Banks should identify the gaps between the existing framework and the WMC scheme-specific handling procedures to derive a WMC scheme framework that can not only fulfil regulatory requirements but also be efficient and streamlined enough to ensure a smooth customer journey.

For investment profiling and KYC, banks should work with their partner banks to gather sufficient client information to perform a holistic review and risk assessment on an on-going basis, and at the same time provide customers with sufficient materials and disclosure to facilitate the investment suitability assessment.

All-encompassing sales approach and investor protection

Hong Kong banks should adopt a long-term business strategy that aligns with the WMC scheme’s requirements on the intended sales approach to facilitate the sales and marketing of its investment products. The HKMA states that the transactions for investors should only be carried out on an execution-only basis and banks aren’t allowed to solicit or recommend individual products to investors.

For now, banks should focus on promoting and improving the investors’ awareness of their WMC scheme services and the investors’ rights in accordance with the arrangements. Apart from the regular staff training that the bank conducts to equip frontline staff with cross-border compliance as well as product and market knowledge, banks should also pay attention to the complaint handling mechanisms and provide timely follow-ups with unsatisfied investors.

Digital services and omni channels

Banks should aim to offer readily available digital services and omni channels to customers as the baseline of an end-to-end client digital journey. This is especially important as the COVID-19 pandemic has fuelled the shift towards remote channels and will only continue to increase investors’ acceptance of a cross-border business model.

Banks should capitalise on this opportunity and invest in a frictionless end-to-end digital journey. The improved digital journey would reduce client’s efforts in travelling to branches, and increase client retention at the same time.

Current banking strategies observed under WMC

The financial industry in Hong Kong is actively engaged in the WMC scheme. At this moment, we’ve observed some common strategies adopted by banks and other financial institutions, such as asset managers and fund managers, to grow and expand their business within the GBA region.

- Define target customer

Leading banks have clearly defined their WMC target customer segments and set up KPIs and business goals towards the WMC scheme or the GBA region.

- Talent acquisition

Most banks see talent acquisition as a critical move to capitalise on the opportunities the WMC Scheme brings. Notably, banks have set aggressive recruitment goals for their client-facing staff and Wealth Management experts to better support high-net-worth clients in Mainland China and Hong Kong by 2025.

- Technology development

Banks are also looking into investments in digital platforms and in-house expertise targeting the Mainland China client segment to facilitate and streamline the client onboarding, investment advice, and product sales processes.

- Products and services

Banks are also developing and promoting suitable cross-border wealth management products to align with the expected low-risk requirements laid out by the HKMA for the first batch of product approvals in October 2021.

- Build partnership

To facilitate the cross-boundary investment process and prepare the onboarding of eligible products, Hong Kong banks are either in process of exploring potential partnerships or have already built partnerships with Mainland China financial institutions.

How Synpulse can help

With the official launch of the WMC Scheme, banks are gearing up for the roll-out of their strategic plans to seize the opportunities and become more knowledgeable of the GBA market.

Synpulse brings our in-depth expertise to the private banking and wealth management sector. We combine it with our experience in implementing cross-border solutions and delivering results with our highly experienced team who are well-versed in the GBA market.

Synpulse supports our clients in defining organisational and system designs and bringing about the transformation to achieve a highly digital and readily scalable operating model. We provide end-to-end solutions for a digital client journey in cross-border onboarding and pre-trade processes and ensure the alignment of the risk and control frameworks while complying with regulatory requirements in all jurisdictions.

1 Implementation Arrangements for the Cross-boundary Wealth Management Connect Pilot Scheme in the Guangdong-Hong Kong Macao Greater Bay Area —HKMA 10 September 2021.

2 PBOC, Guangzhou Branch. Guangdong-Hong Kong-Macau Greater Bay Area "Cross-border Wealth Management" Pilot Implementation Rules. 10 September 2021.

3 Eligible investors in Hong Kong refers to individuals holding a Hong Kong Identity Card (either permanent or non-permanent resident); invests in their personal capcity (not as joint-name or corporate); and has been assessed by Hong Kong banks as not being a vulnerable customer.

4 Renminbi Cross Border Payment & Receipt Management Information System.

5 Cross-border Interbank Payment System.

6 Eligibility refers to a person who is an individual income tax payer for at least five years, or national social security policy holder for at least nine years to nine cities in the Mainland GBA; with more than two years’ investment experience, no less than RMB 1 million of monthly balance of household financial net assets for last three months, and no less than RMB 2 million of monthly balance of household financial assets for last 3 months.

7 List of participating banks for Northbound and Southbound released by HKMA in Oct 2021.