On 6 May 2021, The People's Bank of China (PBOC) published a consultation paper1 with the detailed rules for the launch of the cross-boundary Wealth Management Connect (WMC) Scheme within the Greater Bay Area (GBA). This draft guideline is a follow-up action after the announcement of the WMC Scheme on 29 June 2020, as well as a Memorandum of Understanding (MoU) amongst relevant regulators2 in the region on 5 February 2021.

Key requirements from the draft rules

To strengthen the position of the GBA as a financial hub and facilitate the cross-border trading and investments for GBA residents, the Chinese regulators (PBOC, China Banking and Insurance Regulatory Commission (CBIRC), and China Securities Regulatory Commission (CSRC) have jointly drafted the detailed rules and opened it for industry comments by 12 May 2021.

Key requirements from the draft rules include:

- Definitions of participants, key elements, and processes

- Investment quotas

- Investors eligibility

- Product eligibility

- Closed loop management of funds

- Currency exchange and cross-border remittances

- Investor protection

- Reporting and Supervisory

- Online channels for sales and services

1PBOC, Guangzhou Branch. Guangdong-Hong Kong-Macau Greater Bay Area "Cross-border Wealth Management" Pilot Implementation Rules (Consultation Paper). 6 May 2021.

2 HKMA. Memorandum of Understanding on supervisory cooperation under the Cross-boundary Wealth Management Connect. 5 February 2021

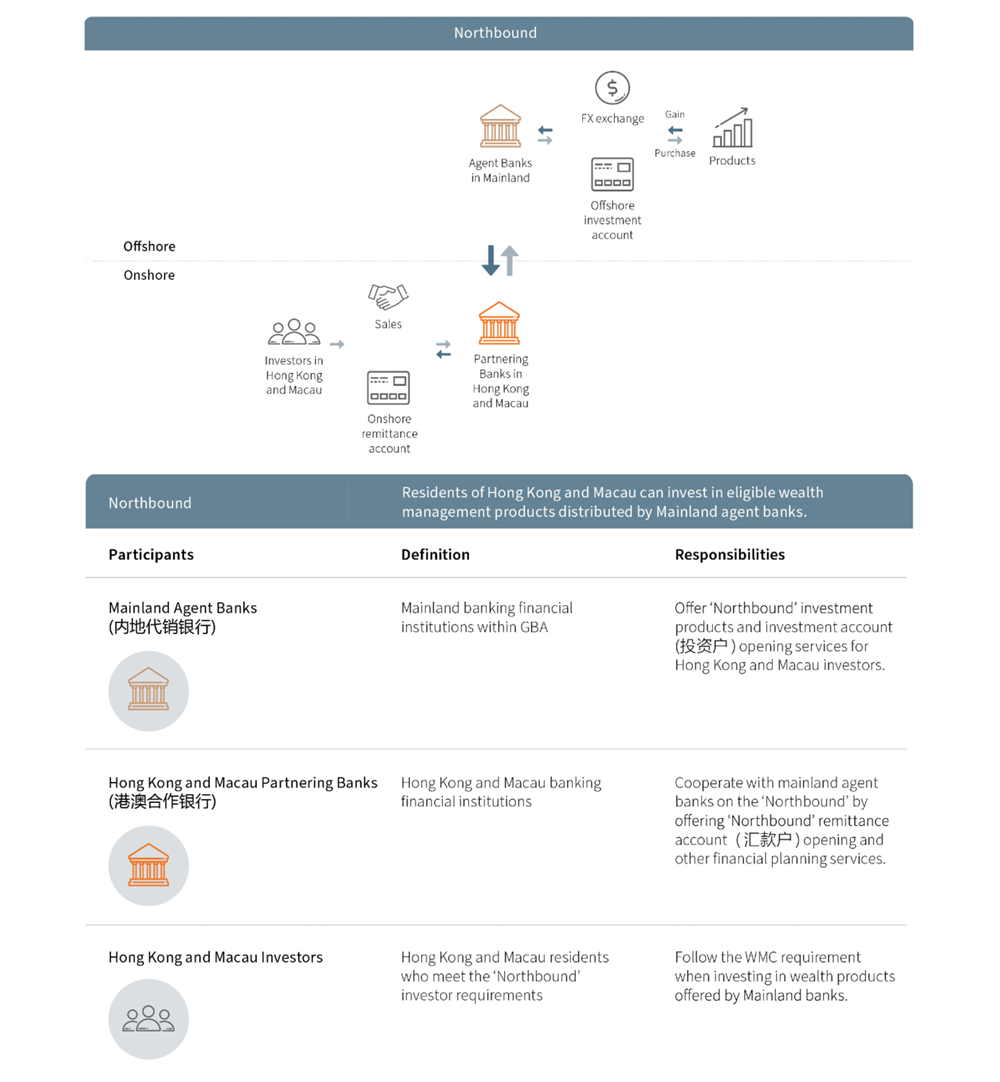

Definition of Northbound participants, key elements and processes:

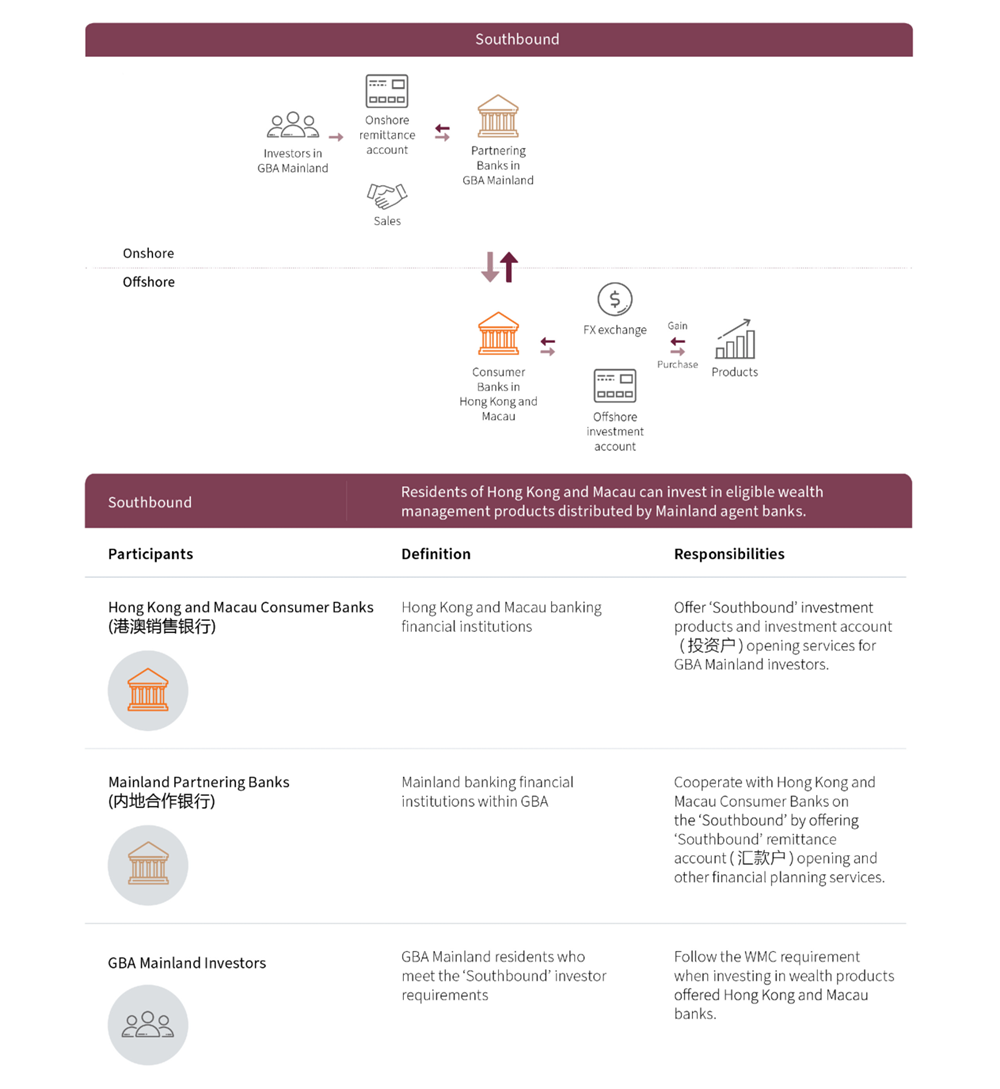

Definition of Southbound participants, key elements and processes:

Investment quota:

- WMC Scheme quota: Net cash flows in either direction (i.e., Northbound or Southbound): RMB 150 billion

- Individual investment quota: RMB 1 million

Investor eligibility:

Northbound: The relevant regulators must confirm the qualifications of eligible Hong Kong and Macau investors, and they must ask the partnering banks in those jurisdictions to carry out the verification.

Southbound: For qualified mainland investors, the southbound investors should meet the following criteria:

- Have the full capacity for civil conduct.

- Have a hukou or a household registration in the nine Mainland cities within the GBA. Check if they have paid individual tax or social security in these cities for five years.

- Have investment experience of two years and above and meet:

a. The threshold of no less than RMB 1 million for family financial net asset month-end balance for the last three months.

b. The threshold of no less than RMB 2 million for family financial asset month-end balance for the last three months.

Product eligibility (Instructions for Northbound products only):

Non-principle guaranteed wealth products (cash management excluded): Issued according to wealth management-related guideline, with a risk rating from “level 1” to “level 3”3. These products are issued by Mainland wealth management companies (including wealth management subsidiaries of banks and joint-venture wealth management company with the foreign party having a controlling stake), according to wealth management related guidelines3.

Public offering of securities investment funds: With a rating from “R1” to “R3” by Mainland public fund managers and Mainland agent banks. Different levels of rating could refer to:

- R1 Averse, Low Risk (e.g. Treasury bond, money market fund);

- R2 Minimal, Low-Medium Risk (e.g. majority wealth product);

- R3 Cautious, Medium Risk (e.g. Bond, commingled fund)

Online channel for sales and services:

- The signing of northbound or southbound business agreements (业务协议) between the partnering bank and the investor can be conducted in person at its onshore branches or via online channels.

- The partnering bank can provide investment advice for investors and sell the investment products in-person at its onshore branches or via online channels. The partnering banks aren’t allowed to cross the border and sell the products offshore.

- Online complaint channels should also be provided by the partnering banks for cross-border investors.

Closed loop management of funds:

- The WMC funds remitted to the investment account will only be used for the designated purpose.

- Closed loop fund transaction is achieved by ensuring both the investment account and the remittance account are held by the same individual who opened both accounts.

- The proceeds from redemption of wealth management products will be remitted back to the remittance account via the same route in Chinese Renminbi.

The State Council, The People’s Republic of China. Level 1 – 5 (Low to High Risk) for Investment Products in Measures for the Supervision and Administration of the Wealth Management Business of Commercial Banks. 26 September 2018

4 R4 Open, Medium-High Risk (e.g., private equity, trust product, equity fund); R5 Actively Seeking, High Risk (e.g., future and option)

Currency exchange and cross-border remittances:

The Pilot Scheme will use Chinese Renminbi for cross-border settlements via CIPS (Renminbi Cross-border Interbank Payment System), and currency exchange is conducted in offshore markets.

Investor protection (Instructions for Northbound Mainland participants only):

To protect the interests of investors in Hong Kong and Macau, the Mainland financial regulators require Mainland Agent banks to take principal responsibilities regarding information disclosure, investment suitability, sales, and services.

Reporting and supervisory (Requirements for Mainland participants only):

- Mainland agent banks and Mainland partnering banks are required to report WMC Scheme information (including products, accounts, transactions, and holdings information) to Mainland financial regulators in a timely manner.

- For supervision, the potential misconducts and enforcements are listed for Mainland agent banks and Mainland partnering banks.

Key takeaways for banks in Hong Kong and Macau to prepare for the WMC launch

The draft rules reveal clear provisions, roles, and responsibilities for the WMC pilot scheme and provide specific guidelines for the banks on how to build a concrete mechanism and get ready.

Qualification for banks:

All banking participants are expected to fulfill the criteria including local registration, cross-border service experience, a well-established control framework, policy and procedure, and resource for WMC business. Specifically, Mainland agent banks and Mainland partnering banks need to have a minimum of three years of cross-border Renminbi service experience. The fund management procedure should be ensured to be closed loop end-to-end by verifying the transfer route of the fund between accounts.

Due diligence and investment suitability:

Banks should perform consistent product due diligence on cross-border investment products to understand the feature and underlying risks, and assess the risk rating with dynamic risk assessment approach. As partnering banks in Hong Kong and Macau for Northbound business, banks should verify the eligibility for local investors before they invest in Mainland products.

On the other hand, as consumer banks in Hong Kong and Macau for southbound business, banks should assess the suitability for Mainland investors, provide full risk disclosure for local products and substantiate without false and misleading statements, or any risk mismatches.

Digital services and omni channels:

To facilitate cross-border investments, an online channel will be widely used during the offshore client on-boarding, investment advice and product sales processes. Banks should develop both onshore branches, online platforms and digital channels to meet the needs of clients and regulators. Banks should also create a communication mechanism and an end-to-end WMC process flow with their onshore branches and incorporate it into the existing framework.

Establishment of WMC investor protection:

Banks should define the policies and procedures for WMC business to fulfill the responsibilities in cross-border investor protection. For southbound business, the consumer banks in Hong Kong and Macau should invest in investor education and provide a package of sales and services tailored for Mainland investors.

System ramp up:

Banks should establish a system to cover WMC specific topics including closed-loop fund mechanism and quota management within the tentative quota of RMB 150 billion as whole and 1 Mio RMB as individual. Banks should also test and assess the capabilities of the system and hand in the corresponding reports to the local regulators.

Next steps

With the draft rules on the WMC schemes from the Chinese regulators, we foresee the supplement rules on WMC participants in Hong Kong and Macau to be released soon. “First come first serve” marks the huge, yet volatile GBA market opportunities, and banks are advised to equip themselves for this upcoming initiative if they are yet to do so.

Synpulse has extensive industry experience in defining and implementing Target Operating Models, as well as ensuring compliant financial services processes control and risk management. We’d be most pleased to discuss with you your cross-border framework, support your expansion into the strategic market of the WMC Scheme, and provide you with further information on the topic.

Synpulse is at the forefront of transformation topics with a team of subject matter experts on the WMC Scheme.