Despite the ongoing market challenges in the past years, the Asia-Pacific (APAC) private banking sector has demonstrated strong growth momentum. The top 20 private banks in Asia, excluding China, have managed to achieve a significant year-on-year growth of 14.8% in assets under management (AUM) to a record-high USD 2.3 trillion in 20201.

In particular, Taiwan has shown strong growth potential compared to other APAC regions thanks to its abundant domestic funds as well as an open regulatory environment. It is expected that the region will nurture one million millionaires by 2025, a 70% increase from 609,000 in 20202. The local authority is eager to seize the opportunity by shifting its retail-focus wealth management to serving High-Net-Worth (HNW) clients with the release of the New Wealth Management Scheme in 2019 and 2020 (WM 2.0). The regulatory initiative aims to accelerate the growth of private wealth management by defining the target customer segment, enabling a diversified scope of financial products, and strengthening the existing regulatory framework.

Current development of WM2.0

The HNW customer segment is defined for the first time in Taiwan by the Financial Supervisory Commission (FSC) as having total assets not less than NTD 100 million, an equivalent of USD 3.5 million. Licensed Financial Institutions (FIs) will be able to offer them tailored financial advice involving relatively complex and high-risk products compared to the retail segment.

As of now, a total of 12 FIs have obtained the license of onshore Private Wealth Management (PWM) business for the next three years.

Figure 1: Operating statistics of WM2.0 from Taiwan's FSC, as of February 20223

Licensing considerations

The license granted to the 12 FIs will be valid for the next 3 years, which allows them to provide PWM services to high-asset clients. All licensees are subject to a review six months before the end of the licensing period which includes evaluation of their operating performance, risk control framework, and financial product development capabilities.

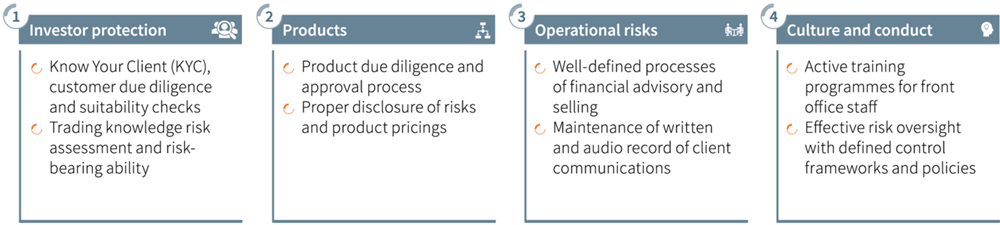

Key regulatory aspects FIs need to consider and focus on to continue their PWM business include:

What banks have been working to shift from retail to high-asset clients?

Banks have taken actions to meet the criteria for getting the license and open up a new business line for wealth management. Here are some trends we’ve observed.

Next steps: What banks should prepare for

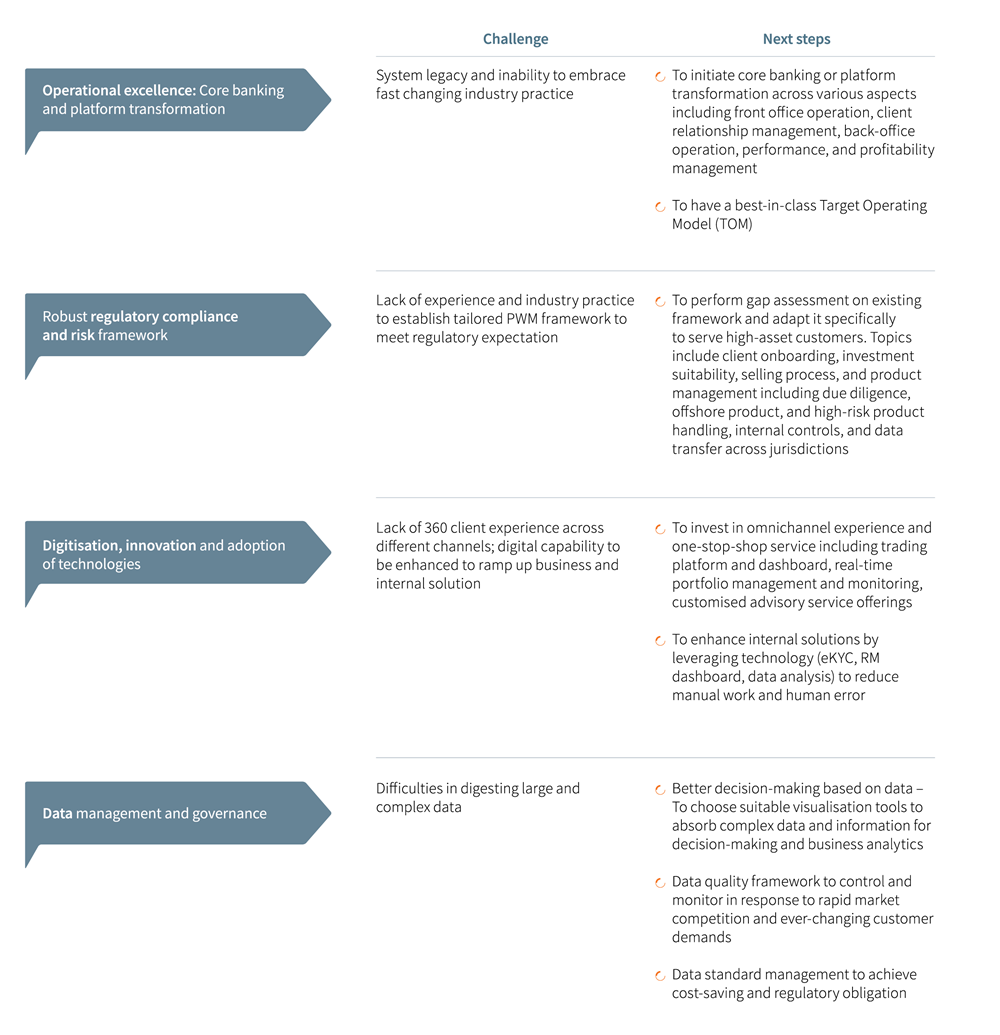

Banks eyeing to gain a market share in the WM2.0 space need to be aware of the specific challenges and take actions. We have identified several challenges and areas that banks need to solve and transform to enhance its competitive advantage in the fast-changing industry.

Why work with Synpulse

Subject matter expertise

Synpulse is at the forefront of transformation topics with solid knowledge and experiences in the industry, under three competence centres in Regulatory Compliance and Risk, Business Innovation and Growth, and Operational Excellence. Alongside supporting our clients in addressing their immediate challenges, Synpulse is committed to bringing transformational solutions to the industry, whether developed in-house or in collaboration with our ecosystem partners.

Extensive industry experience in the Asian market and a key driver of the WM2.0 transformation in Taiwan

Having worked with the largest financial institutions in Asia including Taiwan over the past ten years on an array of successful projects, we understand the most pressing banking challenges in the region and aim to support and help our clients by customising solutions with our proven methodologies.

Reach out to us and we would be most pleased to share industry best practices and provide you with further information on how WM2.0 may impact your organisation.

1 Asian Private Banker. Asia 2020 Private Banking AUM. Accessed: 9 May 2022.

2 Credit Suisse. The Global wealth report 2021. 2021

3 Anue. 7銀行「高資產億元財管」 中信銀資產規模、客戶數奪雙冠 (7 banks classified as “high-asset wealth management”, with CTBC as the leading bank in terms of AUM and number of customers). 22 March 2022.