Discover how the digital revolution is reshaping the landscape of lending in private banking. In this article, we delve into the future of lending and the strategic imperative for banks to adapt in a rapidly evolving industry. We explore the transformative potential of digitisation, uncover key client expectations, highlight automation opportunities, and unveil the emerging concept of Lending as a Service.

Current landscape

Within private banking, automation has made significant strides, but a high amount of manual processing associated to Lombard Lending still exists. While most banks have deployed core lending engines to manage lending facilities and collateral monitoring, structural weaknesses continue to exist prospecting, client onboarding, excess management, margin calls, stress testing and lending reviews.

In this article, we delve into the opportunities for banks to deliver a lending platform aligned with the demands of 2023 and beyond. Our focus will revolve around three key themes: client expectations, automation opportunities and the potential for Lending as a Service.

Your clients expect more

The expectations of clients for digitised lending services are continuously growing. Here are some questions you should be asking yourselves about your current lending services:

- Can your clients easily perform online simulations to determine potential loanable values for placing assets with your bank?

- Do you provide the option for your clients to submit lending applications digitally?

- Can your clients conveniently make drawdowns through online banking?

- Are you still relying on internal emails for margin calls and excess notifications?

- Can your clients independently stress-test their portfolios without needing to request a manual assessment from their relationship manager?

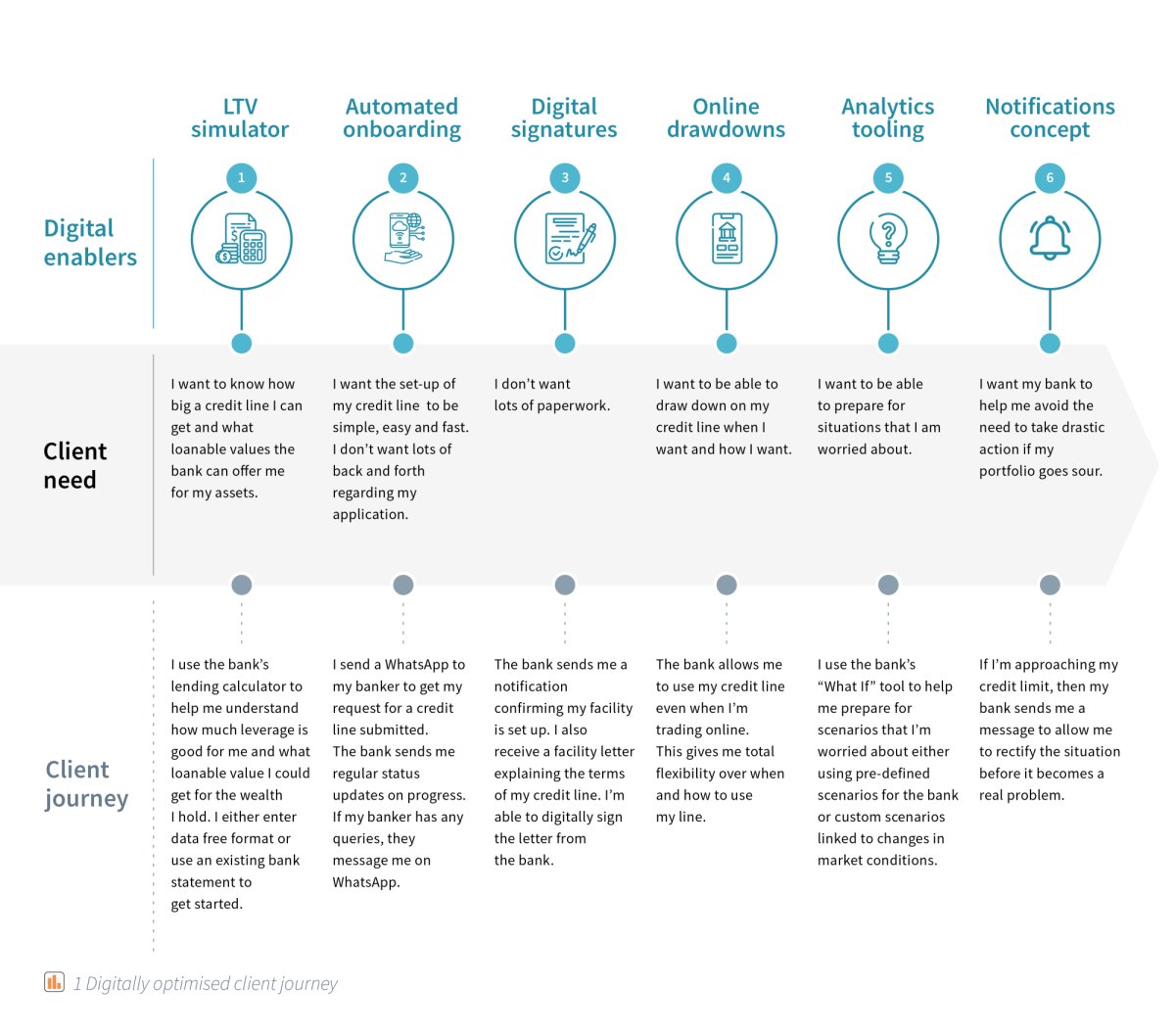

If the answer to any of these questions is “no”, then your platform is at risk of falling well behind competitive standards. At Synpulse, we strongly believe that improved digitisation for lending is no longer a luxury; it is an imperative. We recommend initiating the digitisation process by focusing on lending prospecting and lending onboarding. This can be achieved by deploying tools such as Loan-to-Value (LTV) simulators and lending workflow tools. Additionally, activating lending stress testing features for clients in online banking not only empowers them but also reduces potential reputational risks for your bank. Automating margin call notifications in a final step ensures timely delivery of these important notifications and maximises productivity internally, while helping to minimise lending risk. As a best practice, we recommend taking a step further by implementing predictive “warning” notifications to alert clients when they are approaching or trending towards their utilisation limits.

This results in a digitally optimised journey for clients that looks like this:

The automation revolution

To meet client expectations, banks must continue to reimagine the scale of automation opportunities within their lending technology landscape.

We consistently observe numerous manual gaps in Lombard Lending handling within private banks, particularly in areas where client expectations are increasing. To offer the clients a digitally optimised journey, banks much invest in closing these gaps.

While relying on core banking solutions provides the necessary capabilities for Lombard Lending, there are still gaps these platforms cannot sustainably support, such as LTV simulations, automated lending onboarding, automated lending reviews and smarter automation of lending excess or margin call management. In some cases, banks can explore dedicated third-party solutions to address these automation opportunities, either to manage and deliver their entire lending lifecycle or to supplement the capabilities of their core banking solution.

In the illustration below we detail some of the key automation opportunities for banks to consider when evaluating the next phase of evolution for their lending platform:

Unlocking new opportunities: Lending as a Service

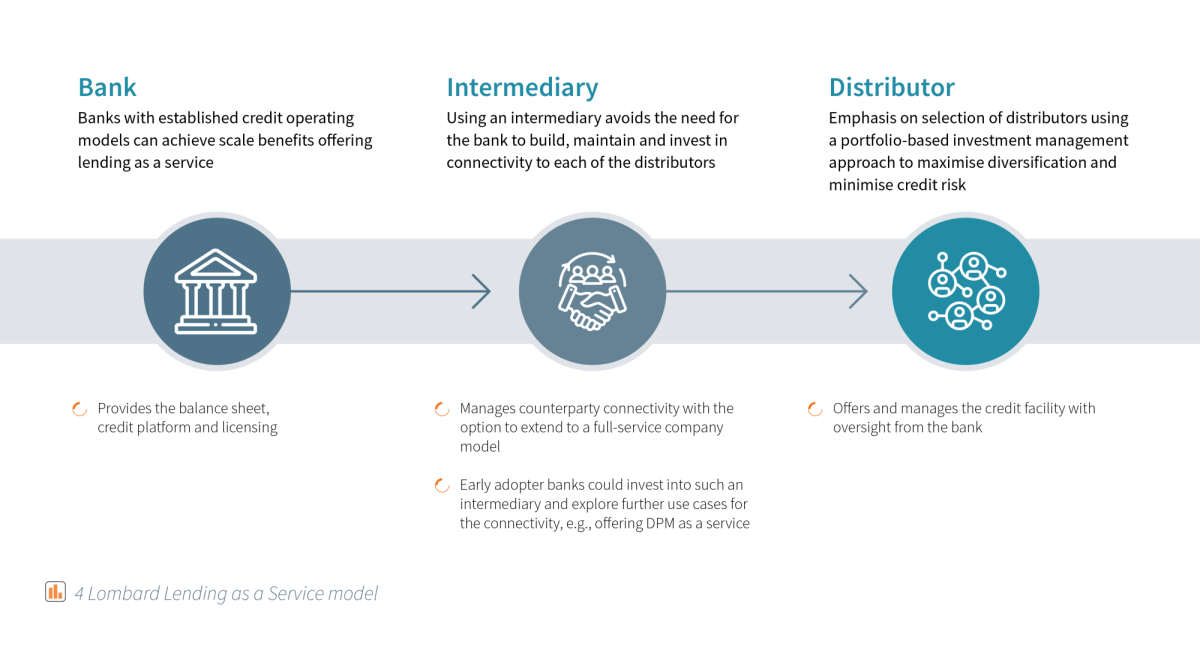

Banks that have already invested in technological solutions to revolutionise their automation and deliver best in class experiences can now focus on maximising the profitability of their investment.

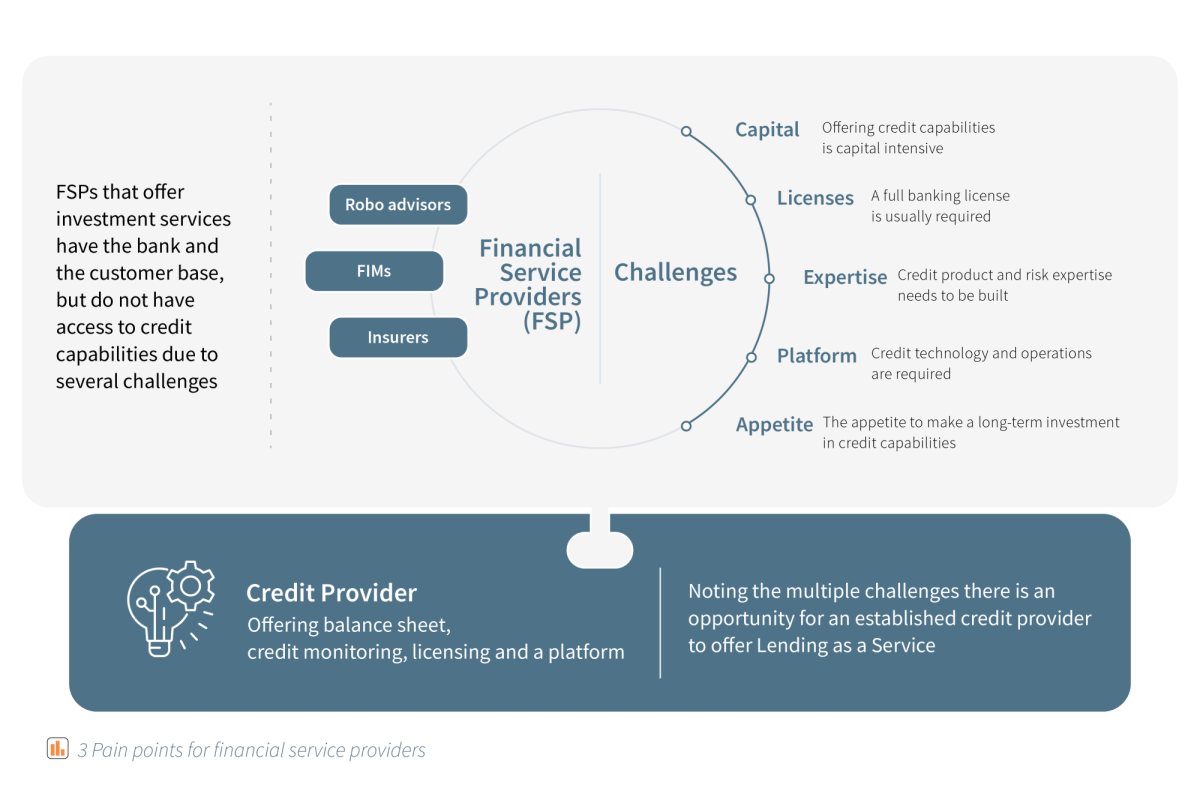

Banks in this privileged position can start to explore the idea of offering their lending platform as a service to other financial institutions. This offering may range from providing the technology alone as a Software-as-a-Service (SaaS) solution to other financial services firms lacking the capability, expertise or inclination to build it themselves. It can also extend to include the availability of lending facilities (i.e., balance sheet) to firms that currently lack this ability. This could involve selling the platform into new markets where Lombard Lending is gaining traction or to firms such as robo-advisors, insurers or financial intermediaries looking for cost-efficient options to launch or scale a lending offering could be part of the strategy.

Banks must establish a carefully defined Target Operating Model (TOM) to capitalise on this opportunity. Exploring the role of an intermediary as a scalable mechanism for reducing acquisition and ongoing servicing costs can further maximise profitability.

Lending as a Service offers significant advantages for early adopters. As interest in the concept grows, it will be crucial for banks to act swiftly and sustainably in building their offering.

How Synpulse can help

Investment in lending automation is becoming a strategic priority for private banks, if it isn’t one already. Clients are demanding more self-service and digitised capabilities, compelling banks to explore further back-end automation. Lending as a Service presents a lucrative opportunity for a fully modernised platform, with substantial benefits expected for early movers. Regardless of your current position, Synpulse is equipped to provide support in designing and executing your lending strategy. Please contact the author to learn more about any of these themes and how we can help you.